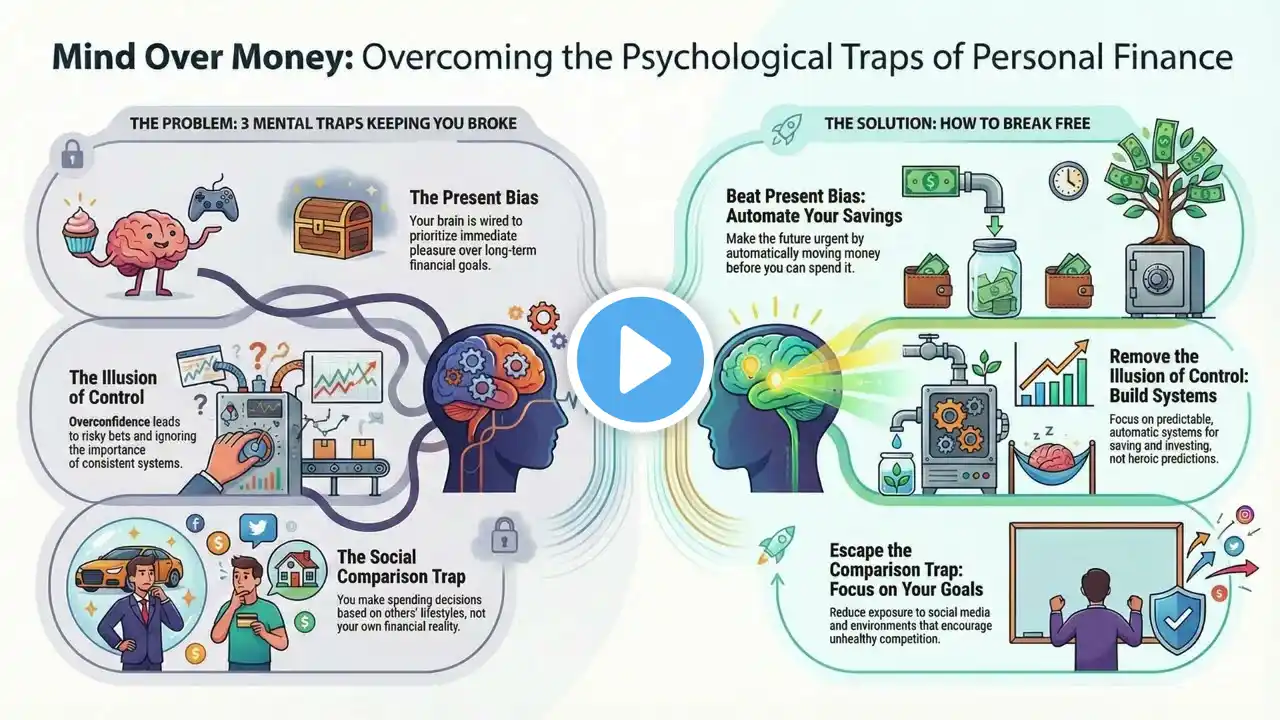

EP 7 - THE PSYCHOLOGY OF MONEY (WHY SMART PEOPLE STAY BROKE)

LEVEL 1: FOUNDATIONS - Why This Is The Starting Point Personal finance is much more than just numbers. It’s a system of habits, decisions, and patterns that shape your financial future. And for most people, those patterns are broken. You might feel like you’re working hard, but you’re still stuck in debt or feel like you’re not making any real progress. Here’s the brutal truth: Most people fail with money because they don’t understand the basic foundation of their finances. The root causes of financial stress are usually found in a few simple areas: • Lack of awareness: You don’t know where your money is going. • Fear and avoidance: Money feels like a constant source of anxiety, so you avoid dealing with it. • Uncontrolled spending: You may think you’re budgeting, but you’re not really managing your cash flow. If any of this resonates, don’t worry. This book will help you stop the bleeding and start the journey toward financial health. But it all starts with awareness. ________________________________________ What You’ll Learn in LEVEL 1: In the chapters ahead, we’ll dive into the core principles that every financially successful person follows—whether they realize it or not. You’ll learn how to: • Understand what personal finance really is—and why most people fail (Episode 1). • Track the flow of money in and out of your life (Episode 2). • Distinguish needs from wants—and cut out what’s draining your finances (Episode 3). • How to budget, even if the idea of budgeting makes you cringe (Episode 4). • Pay yourself first—the simple strategy that the wealthy use to build wealth (Episode 6). • The psychology of money—and why smart people still end up broke (Episode 7). • Avoid common mistakes that most beginners make (Episode 8). • Develop financial discipline without relying on willpower alone (Episode 9). • Net worth explained—why this is the single most important number that truly matters (Episode 10). By the end of this level, you’ll know where your money is going, why you’re stuck, and how to break the cycle of financial stress. Ready to take control? Let’s begin.