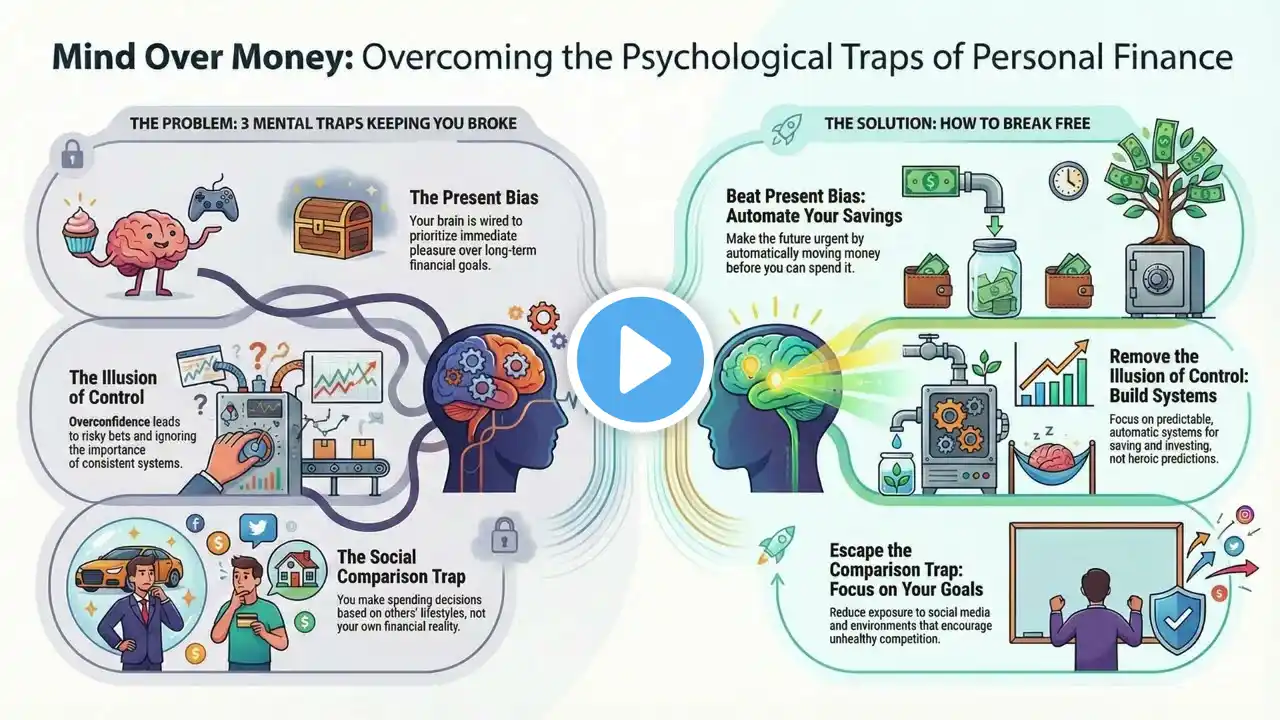

DEEP DIVE: EP 7 - THE PSYCHOLOGY OF MONEY (WHY SMART PEOPLE STAY BROKE)

This is an audio podcast where we cuts through the fluff and shows you what actually matters—from budgeting and saving to investing and beating debt and taxes. No jargon. No sugarcoating. Just real strategies you can use today to take control of your money and your life. Enjoy the infographic accompanying the discussion. LEVEL 1: FOUNDATIONS - Why This Is The Starting Point Personal finance is much more than just numbers. It’s a system of habits, decisions, and patterns that shape your financial future. And for most people, those patterns are broken. You might feel like you’re working hard, but you’re still stuck in debt or feel like you’re not making any real progress. Here’s the brutal truth: Most people fail with money because they don’t understand the basic foundation of their finances. The root causes of financial stress are usually found in a few simple areas: • Lack of awareness: You don’t know where your money is going. • Fear and avoidance: Money feels like a constant source of anxiety, so you avoid dealing with it. • Uncontrolled spending: You may think you’re budgeting, but you’re not really managing your cash flow. If any of this resonates, don’t worry. This book will help you stop the bleeding and start the journey toward financial health. But it all starts with awareness. ________________________________________ What You’ll Learn in LEVEL 1: In the chapters ahead, we’ll dive into the core principles that every financially successful person follows—whether they realize it or not. You’ll learn how to: • Understand what personal finance really is—and why most people fail (Episode 1). • DEEP DIVE: EP 1 – WHAT PERSONAL FINANCE RE... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • Track the flow of money in and out of your life (Episode 2). • DEEP DIVE: EP 2 - HOW MONEY FLOWS IN AND O... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • Distinguish needs from wants—and cut out what’s draining your finances (Episode 3). • DEEP DIVE: EP 3 - NEEDS VS WANTS: THE HIDD... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • How to budget, even if the idea of budgeting makes you cringe (Episode 4). • DEEP DIVE: EP 4 - BUDGETING (THAT DOESN’T ... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • How to track you expense in 10 minutes (Episode 5). • DEEP DIVE: EP 5 - TRACKING EXPENSES IN UND... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • Pay yourself first—the simple strategy that the wealthy use to build wealth (Episode 6). • DEEP DIVE: EP 6 - PAY YOURSELF FIRST (EXPL... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • The psychology of money—and why smart people still end up broke (Episode 7). • DEEP DIVE: EP 7 - THE PSYCHOLOGY OF MONEY ... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • Avoid common mistakes that most beginners make (Episode 8). • DEEP DIVE: EP 8 - THE TOP 5 MONEY MISTAKES... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • Develop financial discipline without relying on willpower alone (Episode 9). • DEEP DIVE: EP 9 - HOW TO BUILD FINANCIAL D... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ • Net worth explained—why this is the single most important number that truly matters (Episode 10). • DEEP DIVE: EP 10 - NET WORTH EXPLAINED (AS... &list=PLIKn6KXVr3PlEqMDNRNUVI2ILdG_TEjGQ By the end of this level, you’ll know where your money is going, why you’re stuck, and how to break the cycle of financial stress.