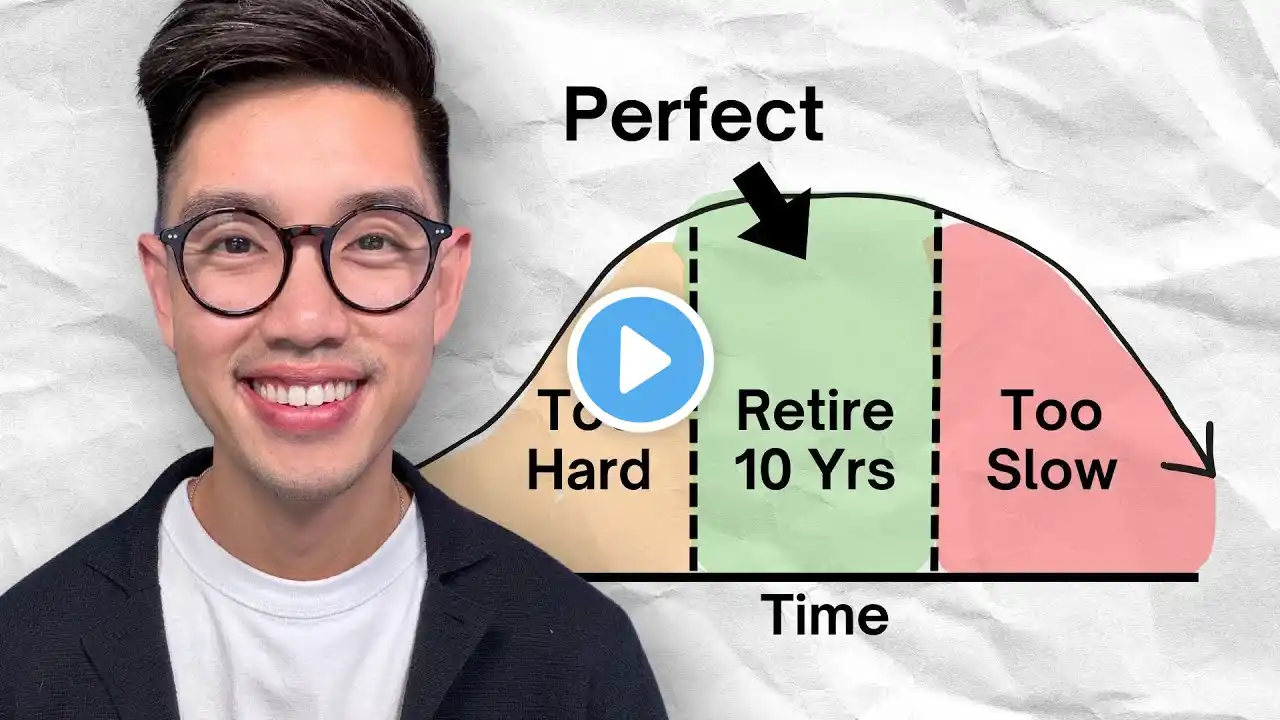

If you're 35 with $0 SAVED... you need to see this NOW

📬 Get my FREE weekly newsletter with exclusive money tips: https://simplyjack.beehiiv.com/ 📔 Track your financial journey with "My Story of Growth" journal: https://tinyurl.com/Mystoryofgrowth -------------------------------------------- V I D E O S T O W A T C H N E X T : The Truth About Passive Income Nobody Tells You: [insert link] How I'd Invest $100 If I Started Today: [insert link] 5 Money Habits Keeping You Broke: [insert link] -------------------------------------------- A B O U T J A C K I N V E S T S Hey, I'm Jack! I turn confusing financial jargon into crystal-clear animated insights you can actually use. Every week, I create easy-to-understand videos that simplify personal finance, investing, passive income, and money psychology — so you can take control of your financial future without needing a finance degree. Here, you'll learn: 💰 How the wealthy build passive income 📈 Simple ways to start investing (even with $100) -------------------------------------------- Business Inquiries: [email protected] -------------------------------------------- Video Summary: An urgent, no-BS emergency fund guide and how to save money roadmap for millennials under 35, Gen Z personal finance, and anyone with zero savings or living paycheck to paycheck, showing exactly why time is running out on compound interest, what bad money habits got them to $0 saved at 30, and the precise 12-month savings challenge to go from broke to $25,000 net worth while rewiring their money mindset, financial literacy, and spending psychology before early retirement, financial independence, passive income opportunities, and wealth building in your 20s pass them by forever through investing for beginners, index funds, and fire movement strategies. Timestamps & Chapters: 0:00 Financial Anxiety: Why You’re Awake at Night 0:36 Under 35 & $0 Saved — Why This Moment Matters 3:05 The Cost of Waiting: Compound Interest Example 5:07 30-Day Playbook (Months 1–3): Financial Reality Check 6:23 Save $1,000 Fast — Your First Emergency Fund 9:33 Debt Destruction Phase (Months 7–9) 11:10 Build a 3-Month Emergency Fund (Months 10–12) 14:00 Start Building Wealth: Index Funds & Consistency 24:19 30-Day Action Plan: Track, Cut, Earn, Save 32:02 Do One Thing Now #investing #personalfinance #passiveincome #moneytips #financialfreedom #wealthbuilding #investingforbeginners #moneymanagement #financialeducation #jackinvests #stockmarket #debtfree #compoundinterest #FIREmovement #moneymindset #smartinvesting #financialliteracy #buildwealth #investingtips #moneyhacks #savingmoney