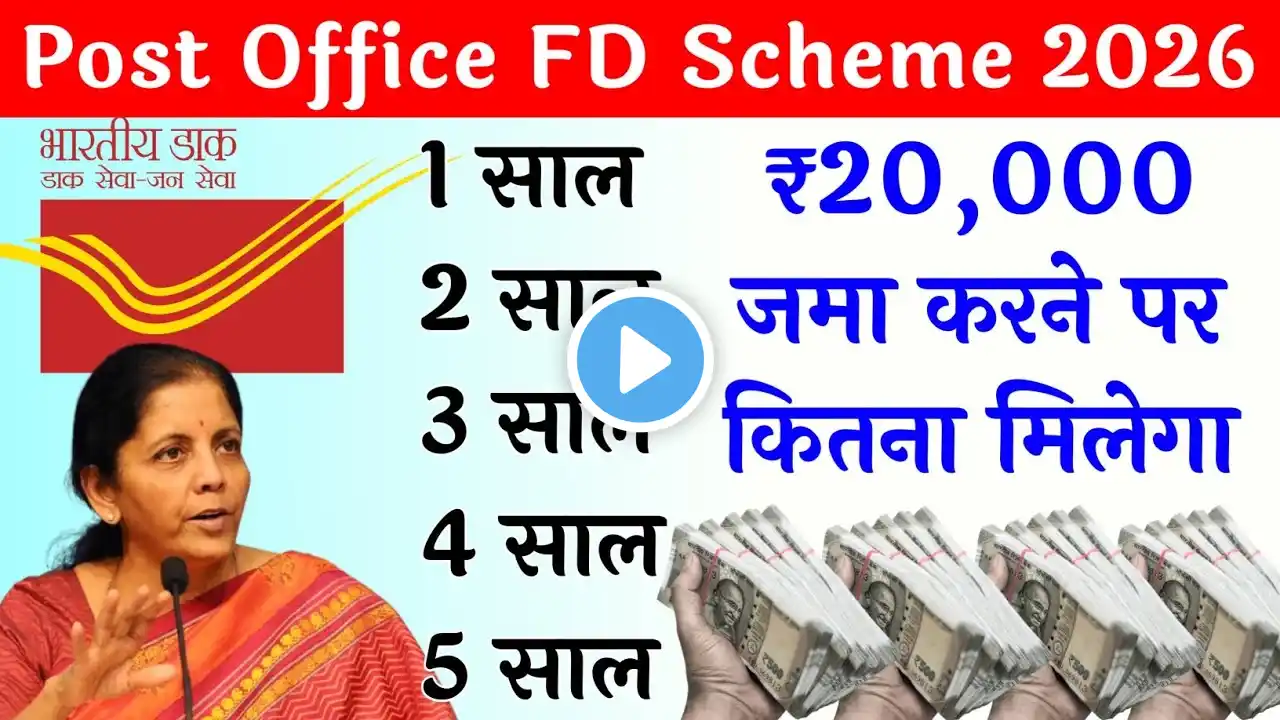

Post Office FD Scheme 2026 | ₹20,000 Investment Return | New Interest Rates & All Rules Explained

Post Office FD Scheme 2026 is one of the safest and most trusted government-backed investment options in India. In this video, we explain everything about Post Office Fixed Deposit (Time Deposit) Scheme 2026, including how much return you will get on an investment of ₹20,000, the latest interest rates, new rules, tax benefits, and maturity details. If you are looking for a safe investment plan, guaranteed return scheme, or a low-risk savings option, then Post Office FD is perfect for you. This scheme is ideal for salaried persons, senior citizens, housewives, and first-time investors. 🔹 What you will learn in this video: ✔ Post Office FD Scheme 2026 full details ✔ ₹20,000 investment return calculation ✔ 1 year, 2 year, 3 year & 5 year FD interest rates ✔ New rules & updates for 2026 ✔ Tax benefit under Section 80C (5 Year FD) ✔ Who should invest in Post Office FD ✔ Comparison with bank FD ✔ How to open Post Office FD account ✔ Maturity amount & premature withdrawal rules. Post Office Fixed Deposit offers stable interest, capital safety, and government guarantee, making it more reliable than many bank FDs. The 5-year Post Office FD also provides tax saving benefits, which makes it attractive for long-term investors. If you want to know whether investing ₹20,000 in Post Office FD in 2026 is profitable or not, then watch this video till the end. This video is explained in simple language so that everyone can understand easily. 👉 Like, Share & Subscribe for more videos on Post Office schemes, FD, RD, NSC, MIS, PPF & government investment plans. Thanks for watching 🙏 #PostOfficeFDScheme2026 #PostOfficeFD #FDInvestment2026 #PostOfficeInvestment #FixedDepositScheme #SafeInvestment #GovernmentScheme #FDReturn #PostOfficeSavingScheme #TaxSavingFD #FDvsBankFD #IndianInvestment