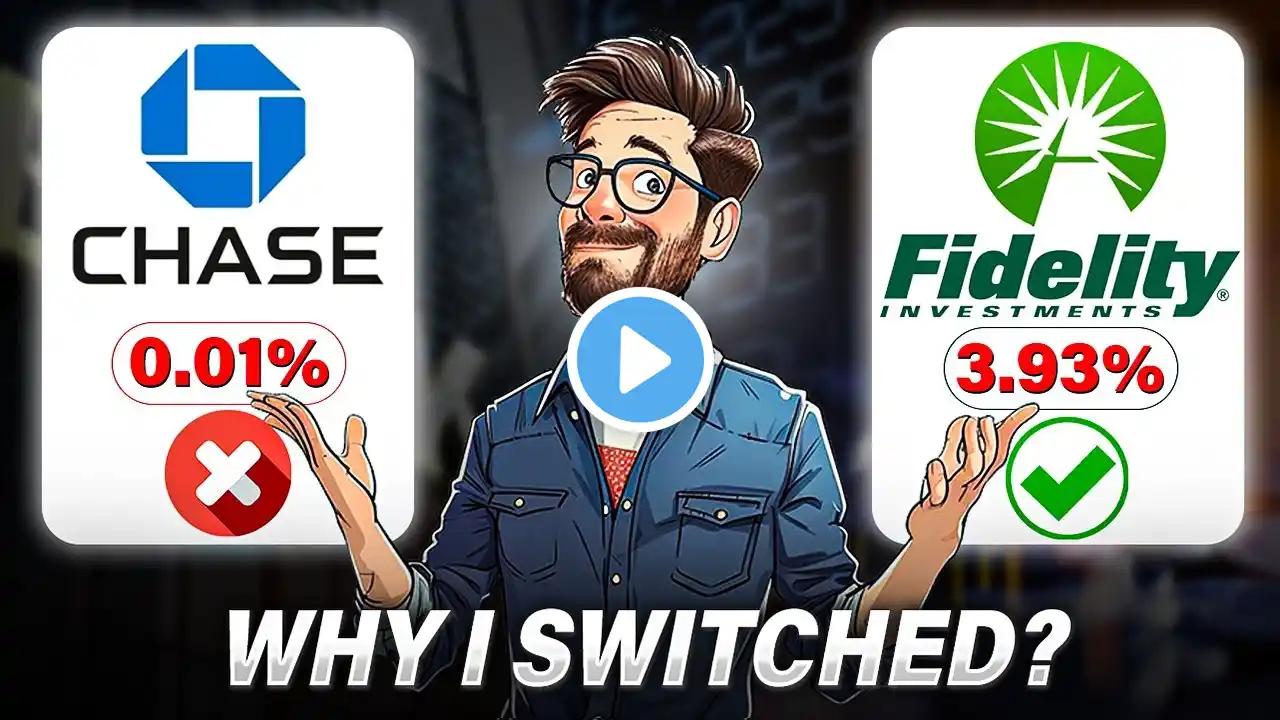

Why I'm Leaving My Bank for the Fidelity Cash Management Account

Here's my channel with all my content: / @harrysbullrun Why I'm Leaving My Bank for the Fidelity Cash Management Account. Earning less than 1% on your savings? You're losing money to inflation daily! The TRUTH About banking is that Fidelity's Cash Management Account (CMA) could be paying you up to 10x MORE (like 3.93% via SPAXX!) AND offer FDIC protection up to $5 MILLION. This video reveals why I'm leaving my bank and how this could change your cash management forever. 📊 Top Market Research Platforms - Save Big & Start Smart 🔍 Seeking Alpha Premium - Get in-depth stock analysis, expert opinions, and powerful research tools. ✅ $30 OFF + 7-Day FREE Trial 👉 https://link.seekingalpha.com/4B5GHXF... 📈 Alpha Picks + Premium BUNDLE - Get top stock recommendations plus all Premium features. 🔥 Save $159 Now 👉 https://link.seekingalpha.com/4B5GHXF... 📊 Alpha Picks Only - Let Seeking Alpha’s team do the research for you with two top stock picks each month. 💸 Get $50 OFF 👉 https://link.seekingalpha.com/4B5GHXF... Stop settling for pitiful bank interest (0.45% APY average!). This Ultimate Guide explores why Fidelity's Cash Management Account is a game-changer. Learn how it's NOT a bank account but a brokerage account, offering superior yields through options like the SPAXX money market fund (3.93% 7-day yield!) or an FDIC-insured sweep (2.21% APY). Discover how you can get up to $5 MILLION in FDIC insurance, the comprehensive features (debit card, ATM reimbursements, bill pay), tax optimization with SPAXX (state tax exemption!), and my personal hybrid strategy for maximizing benefits. We cover limitations (no cash deposits) and the crucial differences between SPAXX and the FDIC sweep. ✅ The Traditional Banking Problem: Low yields (0.45% APY) vs. Fidelity's SPAXX (3.93%+). ✅ Fidelity CMA Explained: Brokerage account structure, core positions (SPAXX vs FDIC Sweep). ✅ Yield Analysis: Comparing SPAXX (3.93%) and FDIC Sweep (2.21%) to bank rates. ✅ $5M FDIC Insurance: How Fidelity's sweep program achieves this. ✅ Comprehensive Features: Debit card, ATM fee reimbursements, bill pay, mobile app. ✅ Tax Optimization: SPAXX's state tax exemption advantage. ✅ Limitations & Considerations: No cash deposits, settlement times. ✅ My Personal Strategy: Hybrid approach for maximizing yield and utility. ✅ Risk Assessment: Money market fund risks vs. FDIC guarantees. Are you ready to make your cash work harder? Does the Fidelity Cash Management Account sound like a fit for you? Share your thoughts or current cash strategy in the comments! 👇 If this deep dive helps you make smarter money moves, hit LIKE & SUBSCRIBE! ⚠️⚠️⚠️ Disclaimer: I am not a financial advisor. This channel does not provide investing, tax, legal or accounting advice. This video is for entertainment and educational purposes only and should not be considered as financial advice. I am solely sharing my personal experience and opinions. I highly encourage you to do your own research- there is a risk of losing money in the market. You should consult your own tax, legal and financial/investment advisors before engaging in any transactions. 🚨Thumbnails are NEVER a direct quote from any public figure. It is a form of art and is strategically used for audience engagement. DO not rely on the "quote" as a real statement from a public figure. 🚨Advertiser Disclosure: The links provided on this channel are from affiliate partners, which means that if you make a purchase through my affiliate link, I may earn a small commission at no cost to you. #FidelityCMA #HighYieldSavings #CashManagement