No Dues Certificate| Change Owner(Name/ Mobile) in Property Tax online| Step by Step

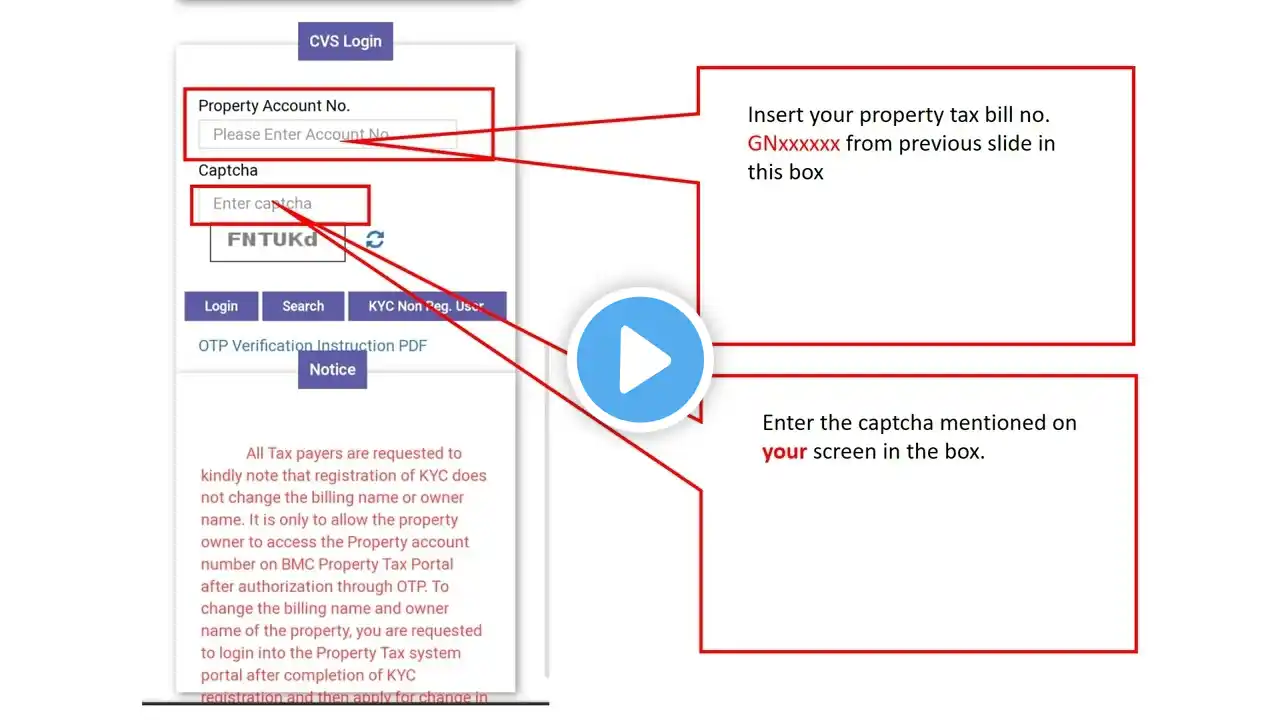

How to update owner details (Name/ Mobile) in Municipal Corporation online| Property Tax| No Dues Certificate Important Links Expert Tips And Tricks To Buy A Property From An NRI ! - • Are you sure of buying property from a NRI... How to apply for TAN - • How to apply for a New TAN online in 5 min... Pay TDS – Can use TDS Return (234E) link TDS return(form 27Q-payment to Non-Resident) – • Payment to Non-Resident| How to file TDS r... How to register on Traces Website as Deductor - • Traces Website registration as Deductor fo... How to issue Form 16A - • How to issue Form 16A | Form 16 vs 16A | A... TDS return U/s 234e (Late Filing) - • File TDS Correction Online| Latest Process Change Owner(Name/ Mobile) in Property Tax - • No Dues Certificate| Change Owner(Name/ Mo... Pay Property Tax Online - • New Process | No Dues Certificate| Pay Pro... Buy or Rent a house ? - • Confused? Guaranteed Decision ! Buy or Ren... Best REIT in India - • Best REIT in India| Real Estate Investment... Whenever there is a change of ownership of a property, the new owner must get the name changed in the property tax. Otherwise, the previous owner will be liable to pay the taxes legally since the corporation is not notified of the sale of the property. The buyers should give their utmost attention to this as property tax is also proof of the rightful ownership over the property. The fear of lengthy procedures may be one of the reasons that buyers hesitate to change the name in the property tax. However, the process to get the name changed in property tax is very easy and does not take much time. Website https://www.mcg.gov.in/HouseTax.aspx https://ulbhryndc.org/ The buyers need to transfer the property tax to their name. Property tax can serve as proof of ownership of the property. Also, the previous owners will be liable to pay the taxes legally if the name in the property tax is not changed. There are various other receipts that the new owner should transfer in his/her name along with the mutation of the property tax for a seamless transfer of title of ownership to the premise. After submission of the application, you’ll have to wait for 15 to 30 working days for the change of name as the officers will verify the claims and provide approval accordingly.