💯The EASIEST Way To Get Your e-PAN WITHOUT YOUR PAN Number💯#PanCardDownload #onlinework #pancardlink

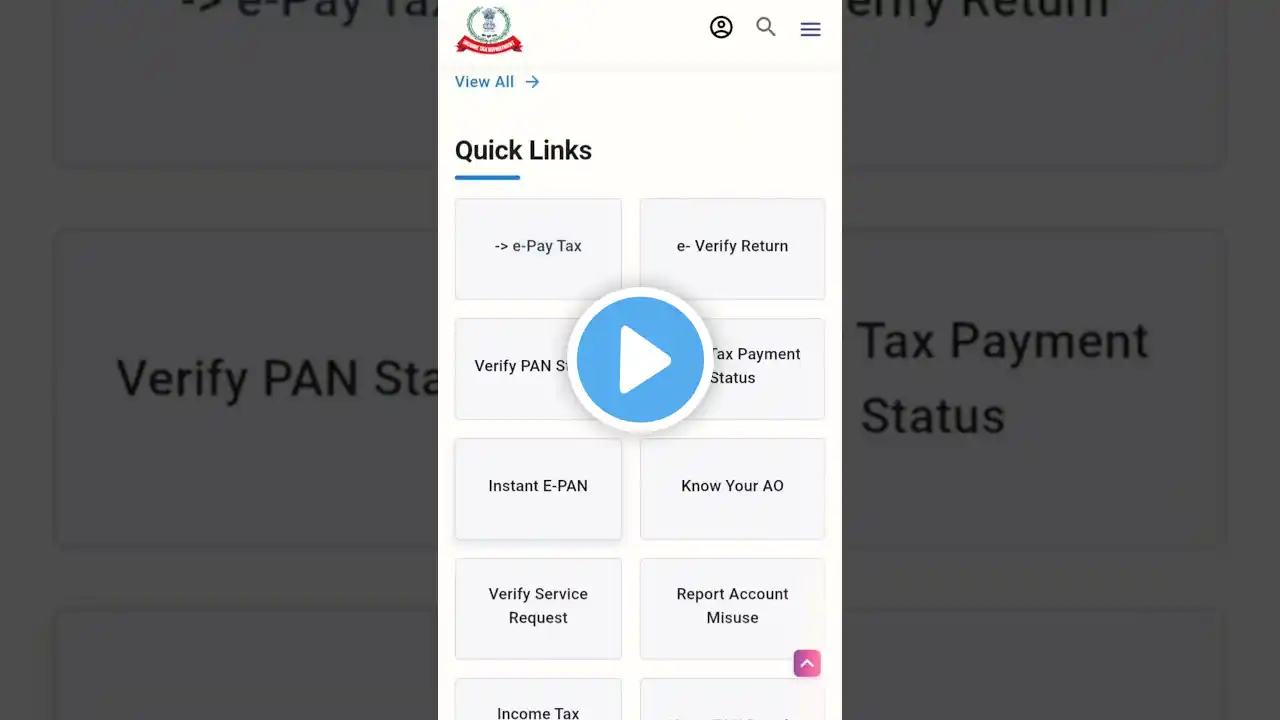

You can use the description below. Fill in your channel's specific links where indicated. --- *Lost or forgot your Permanent Account Number (PAN)? No problem!* This video shows you the step-by-step methods to **download your e-PAN card without needing your PAN number**. You can use your Aadhaar or the acknowledgement number from your application to get a legally valid digital PAN instantly. *Key Methods Covered in this Video:* ✅ *Download via Aadhaar (Instant e-PAN):* Use your Aadhaar number and OTP on the Income Tax e-filing portal. ✅ *Download via Acknowledgement Number:* If you recently applied for a PAN, use the 15-digit number to download from the NSDL/Protean portal. ✅ *Download via DigiLocker:* Find your PAN verification record if it's already linked. *Important Prerequisites & Info:* Your *Aadhaar must be linked to your mobile number* for OTP verification. Download is *free within 30 days* of PAN allotment or update. A small fee may apply later (around ₹8.26 to ₹26). The downloaded PDF is password-protected. Use your *date of birth in DDMMYYYY format* to open it. The e-PAN is a *legally valid document* for all financial and identification purposes. *Official Portals Used (Only use these):* Income Tax e-Filing Portal (for Aadhaar method): [www.incometax.gov.in](https://www.incometax.gov.in) NSDL/Protean Portal: [www.protean-tinpan.com](https://www.protean-tinpan.com) UTIITSL Portal: [www.pan.utiitsl.com](https://www.pan.utiitsl.com) --- *Subscribe for more useful guides on finance, taxes, and digital India!* *🔔 Turn on notifications so you never miss an update.* *👍 If this video helped you, please give it a thumbs up!* *💬 Got questions? Ask in the comments below.* *Connect with us:* [Link to your other social media platforms] *Disclaimer:* This video is for educational purposes. The process is based on official government portals. For specific issues, contact the **PAN Helpdesk at 020-27218080**. --- Key Points to Include in Your Video For your video script, here is a comparison of the two main methods to help you structure your content clearly: *Method 1: Using Aadhaar Number (Instant e-PAN)* *Where to Go:* Income Tax e-filing portal *Key Requirement:* Aadhaar linked to mobile for OTP *Best For:* Fastest way to get e-PAN if Aadhaar is linked *Method 2: Using Acknowledgement Number* *Where to Go:* NSDL/Protean portal *Key Requirement:* 15-digit number from PAN application *Best For:* Those who recently applied and have the acknowledgment I hope these suggestions help you create a great video. If you'd like a detailed, step-by-step script for any of the methods, just let me know #PanCardDownload #EPan #AadhaarCard #IncomeTaxIndia #NSDL #UTIITSL #DigitalIndia #FinanceTips #TaxFiling #PanCardOnline