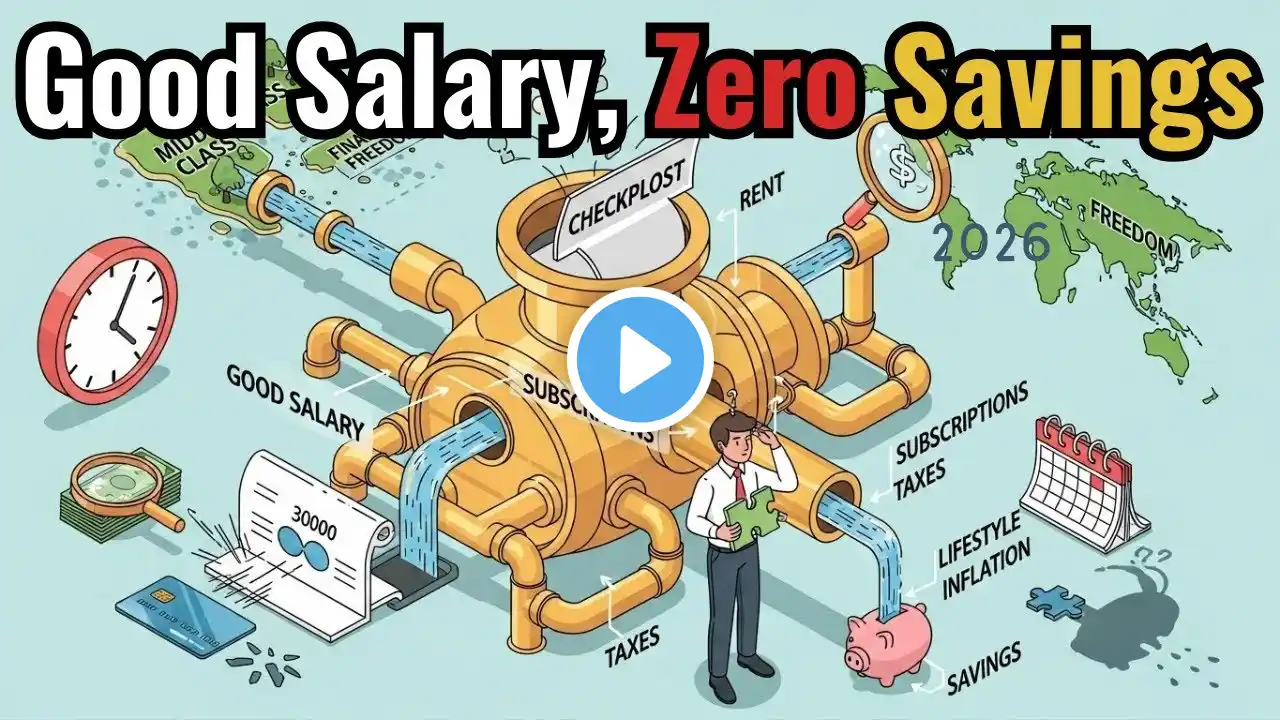

Why You're Broke Even With a "Good" Job

Why You're Broke Even With a "Good" Job" 💸 You earn a solid salary, you're "responsible," but you're always one surprise away from broke. We diagnose the 3 systemic forces—Asset Inflation Tax, Subscription Adulthood, and Expectation Assimilation—that dismantle your paycheck before you even see it. Using data-driven analysis, we reveal why a $72k salary today feels like a $38k lifestyle a generation ago. Then, we give you a 4-phase "Cash Flow Architecture" plan to escape the squeeze and build real wealth. 📊 ANALYSIS & DATA REFERENCED: • U.S. Bureau of Labor Statistics: CPI vs. Wage Growth by Occupation • Federal Reserve: Survey of Consumer Finances - Housing Cost Burden • Bloomberg: "The Subscriptionization of the Middle Class" Analysis • Pew Research: The Squeezed Middle Class (Purchasing Power Over Time) ⏱️ TIMESTAMPS: 0:00 - The "Good Job" Paradox 1:45 - Chloe's Story: The $72k Salary with $0 Disposable Income 3:30 - Systemic Force 1: The Asset Inflation Tax (Housing, Cars) 5:15 - Systemic Force 2: The Subscription Model of Adulthood 7:00 - Systemic Force 3: The Expectation Assimilation Engine 8:45 - The Shocking Math: Your 2024 Salary's True 2000 Buying Power 10:30 - PHASE 1: The Liquidity Audit & Fixed-Cost War (Target: -20%) 12:15 - PHASE 2: Build Your "Personal Monopoly" Side Engine 13:45 - PHASE 3: Opt Out of Mindless Convenience Spending 15:00 - PHASE 4: Re-define "Good Life" Around Assets, Not Access 16:30 - Your First Mission: Target Your Top 3 Fixed Costs 17:15 - Next Video: The Personal Monopoly Blueprint ($2k/Month Side Hustle) 💬 DECLARE YOUR FINANCIAL WAR: • What is your #1 fixed cost target and your planned action? (e.g., "$450 Car Payment → Sell, buy with cash") • Which of the 3 systemic forces hit you the hardest? • Are you ready to build a "Personal Monopoly"? Share your battle plan below. Let's build a community of architects. 👇 🏗️ YOUR 4-PHASE CASH FLOW ARCHITECTURE (Not Financial Advice): AUDIT & RECLAIM: List all fixed costs. Target a 15-20% reduction via refinancing, downsizing, or eliminating (e.g., sell financed car). DIVERSIFY INCOME: Build a "Personal Monopoly"—leverage job skills for a $1k+/month freelance service (5 hrs/week). OPT OUT STRATEGICALLY: Audit convenience spending. Only pay for services that free up time for high-value tasks (Phase 2) or essential rest. INVEST IN ASSETS: Redirect all reclaimed cash flow to emergency funds, problem-solving assets (e.g., ebike to replace car), and financial assets (Roth IRA, brokerage). ⚠️ DISCLAIMER: This video is for educational and informational purposes only. It is not personalized financial, career, tax, or legal advice. All examples, including Chloe's story, salary comparisons, and economic analysis, are hypothetical or based on aggregated public data for illustrative purposes. "Personal Monopoly" income is not guaranteed. Downsizing assets or refinancing debt has costs and risks. Your personal circumstances are unique. Please consult with qualified financial advisors, tax professionals, and career counselors before making significant financial or employment decisions. Results are not typical and require significant effort and discipline. 🏷️ TAGS: why im broke, good job, salary, paycheck to paycheck, middle class squeeze, asset inflation, subscription economy, lifestyle creep, fixed costs, cash flow, personal monopoly, side hustle, freelancing, financial independence, escape the rat race, budgeting, money management, adulting, modern economy, cost of living, housing crisis, student loans, convenience spending, time vs money, build assets, recession proof, millennial money, gen z money, financial planning, wake up call, Bloomberg analysis, systemic problem, solve burnout, take control, financial architecture, disposable income, buying power, inflation, wage stagnation