How Liquidity Works in Financial Markets | ICT Liquidity Concepts Explained

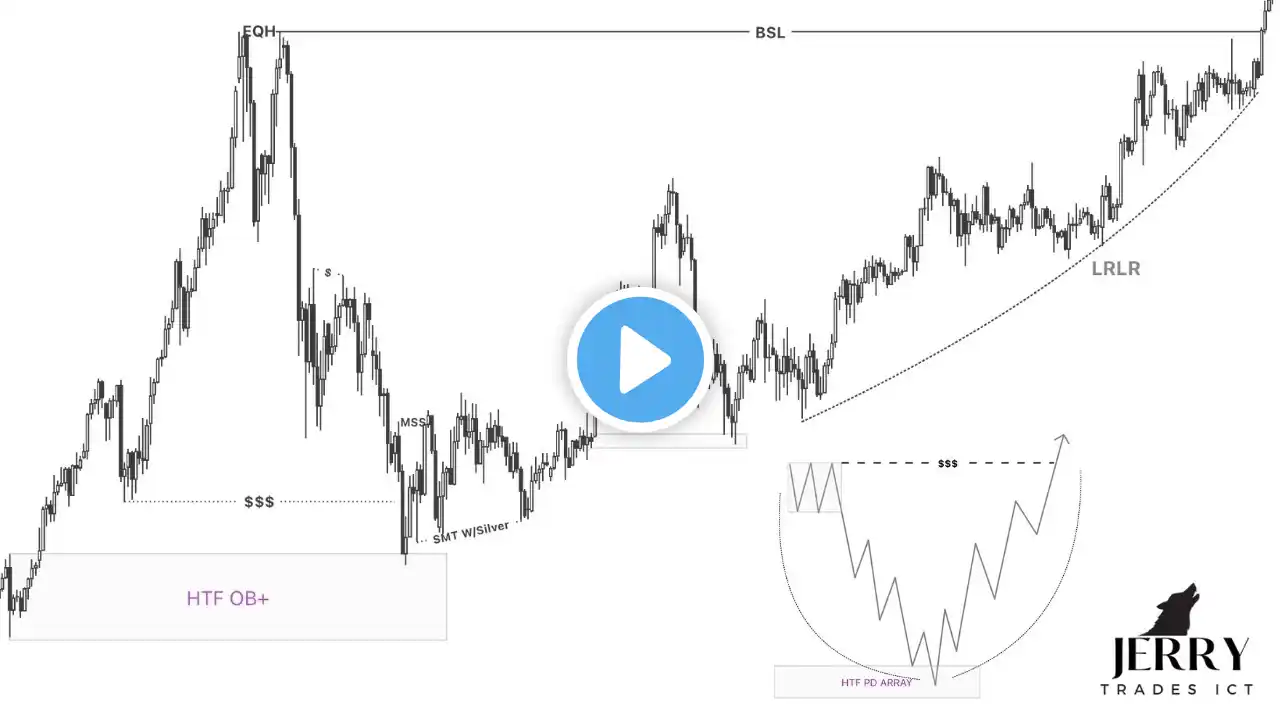

In this video, we break down liquidity in financial markets from a Smart Money & ICT trading perspective. Liquidity is the foundation of price movement, and understanding where liquidity rests gives traders a massive edge in reading market structure and anticipating future price delivery. You’ll learn how buy-side liquidity and sell-side liquidity are formed around swing highs and swing lows, and why price is consistently drawn toward equal highs, equal lows, trendlines, and key support and resistance levels. These areas act as liquidity pools where institutions and smart money execute large orders. This video explains: What liquidity really means in trading Buy Side Liquidity vs Sell Side Liquidity Liquidity above swing highs and below swing lows Equal Highs & Equal Lows as resting liquidity Trendline liquidity and false breakouts Support & Resistance liquidity traps Why the market hunts liquidity before major moves Real chart examples for better understanding Whether you trade Forex, Indices, Crypto, or Stocks, these liquidity concepts remain universal and are heavily used in ICT trading, Smart Money Concepts (SMC), and institutional price action. This video is ideal for: ICT & Smart Money traders Price action traders Intraday & swing traders Traders wanting to understand why price moves, not just where 📈 Master liquidity, and you’ll stop chasing price—you’ll start anticipating it.