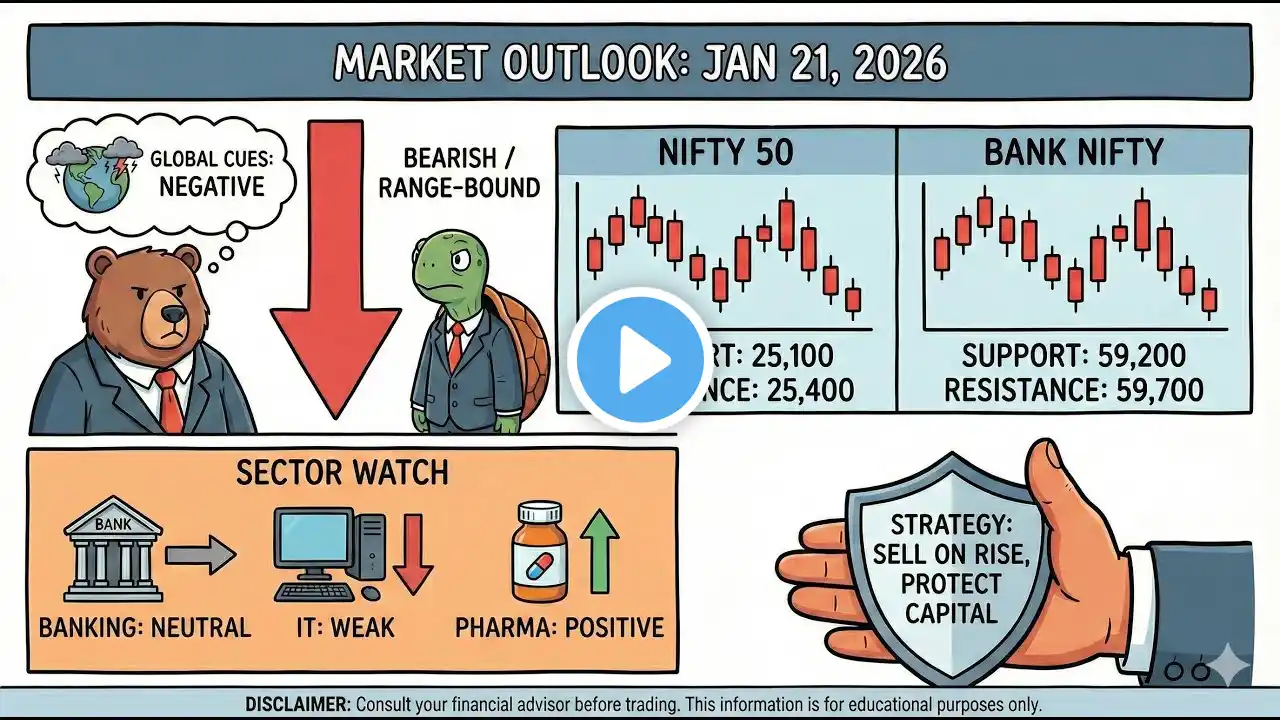

MARKET ALERT: Sell on Rise? | Nifty & Bank Nifty Prediction for Today (21 Jan 2026) | WWH InShort

Market Outlook: Wednesday, 21 January 2026 Global markets are flashing red! Following a sharp sell-off in the US markets overnight due to renewed trade war fears, the Indian indices are set for a challenging session. Nifty has broken the crucial 25,500 support zone—what should traders do now? In this video, we analyze the impact of rising US bond yields, FII selling, and the technical setup for Nifty and Bank Nifty. 🔍 Key Highlights Covered: Global Cues: Why US & Asian markets are bleeding. Nifty 50 Strategy: Why the trend has shifted to "Sell on Rise." Key Levels: Critical Support at 25,100 & Resistance at 25,400. Sector Watch: Why IT & Metals are weak, and where to hide (Pharma/FMCG). FII Data: Institutional flow analysis. 📊 Today's Strategy: Avoid aggressive buying. The market texture is weak. Watch for shorting opportunities on bounces near resistance levels. Protect your capital! CHAPTERS: 0:00 - Global Market Sell-Off Explained 1:30 - Nifty 50 Technical Analysis & Levels 3:45 - Bank Nifty View: Range-bound? 5:20 - Sectoral Trends: IT vs. Pharma 6:50 - Final Verdict & Trade Setup Disclaimer: This analysis is for educational purposes only. I am a strategist, not a financial advisor. Please consult your certified investment advisor before taking any trades. #marketprediction #trading #tradingstrategy Like, Share and Subscribe the channel WWH InShort.