"How to Calculate Your Home Loan EMI Easily" #shorts

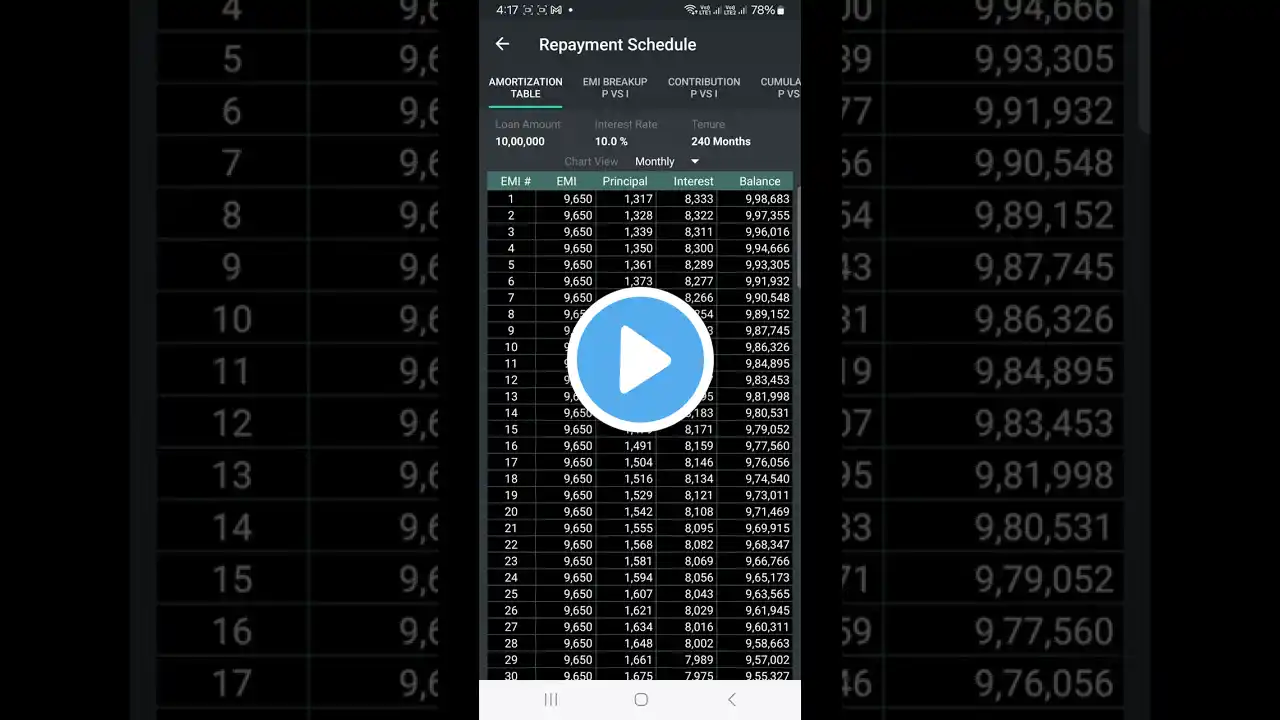

In this video, we will walk you through how to calculate your home loan EMI easily and accurately. Whether you’re planning to buy a new house or are currently in the process of securing a home loan, understanding your EMI (Equated Monthly Installment) is crucial. It helps you plan your finances better and ensures that you can comfortably manage your monthly payments without stretching your budget. Calculating home loan EMI is a simple yet vital step that will give you a clear picture of how much you need to pay every month to repay your loan. In this video, we will explain how to use a home loan EMI calculator, manually calculate EMI using a formula, and give you tips on how to get the best interest rates. We will also show you how different factors like loan tenure, interest rates, and loan amount can impact your EMI. What is EMI? EMI stands for Equated Monthly Installment, which is the fixed monthly amount that borrowers need to pay to the bank or NBFC for a home loan. It includes both the principal amount and the interest amount, spread over the tenure of the loan. The EMI remains fixed throughout the loan period unless the interest rates change in case of floating-rate loans. How is Home Loan EMI Calculated? There are two ways to calculate home loan EMI: manually using the EMI formula and using an online EMI calculator. The formula for EMI is: EMI = [P x R x (1+R)^N] / [(1+R)^N – 1] Where: P = Principal loan amount R = Monthly interest rate N = Loan tenure in months Though manual calculation can be complex, using an EMI calculator online is quick and hassle-free. With just a few inputs like loan amount, interest rate, and loan tenure, you can get instant results on the monthly EMI. This tool is particularly useful when comparing various loan options offered by banks and NBFCs. Why Understanding EMI is Important? Knowing your home loan EMI before taking the loan allows you to plan your budget effectively. It ensures you don’t take on more than you can afford and helps you decide on the right loan tenure and amount. By tweaking the loan tenure and interest rate, you can find an EMI that fits your monthly financial capabilities. We will also share tips on reducing your EMI, such as opting for longer loan tenures or negotiating for lower interest rates with your lender. Additionally, we’ll cover prepayment options, which allow you to reduce the overall interest burden and shorten the loan period. Factors that Affect EMI Loan Amount: A higher loan amount means a higher EMI. Interest Rate: A lower interest rate can significantly reduce your EMI. Loan Tenure: Longer loan tenures spread the EMI over more months, reducing the monthly installment. Whether you're looking to apply for a home loan or simply want to understand how home loan EMI works, this video will provide you with all the necessary information and tools. By the end of this video, you’ll be confident in calculating and finding the best EMI plan that works for you. Make sure to subscribe to our channel for more financial tips, loan guides, and step-by-step tutorials on various financial topics.