IAS 12 - LECTURE 1 - PART 4 - P & D (23 Min)

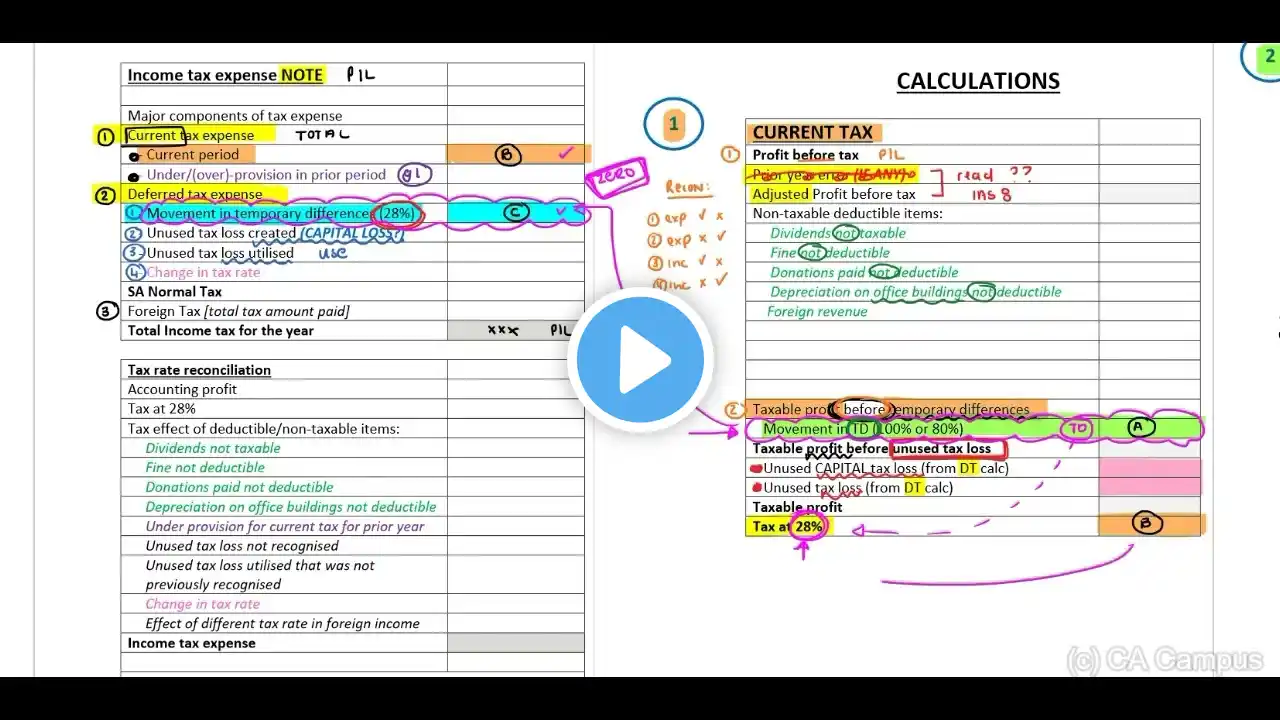

Master IAS 12 with Confidence! This video is part of our comprehensive series on IAS 12: Income Taxes. Gain clarity on key concepts, practical applications, and exam techniques tailored for accounting students. Topics Covered: ✔ Deferred tax recognition and measurement ✔ Taxable and deductible temporary differences ✔ Accounting vs. taxable profits ✔ Practical examples and case studies Stay tuned for more videos to enhance your understanding of financial reporting standards. 📥 Free Study Resources Download detailed notes and templates to follow along with the lessons. (https://drive.google.com/drive/folder...) 🎯 Ideal For: CTA students and anyone pursuing a deeper understanding of IAS 12. 📢 Don't forget to like, share, and subscribe for more expert accounting content!