MTF Explained | Margin Trading Facility Benefits & Risks | Hedging MTF Portfolio with Nifty50 Option

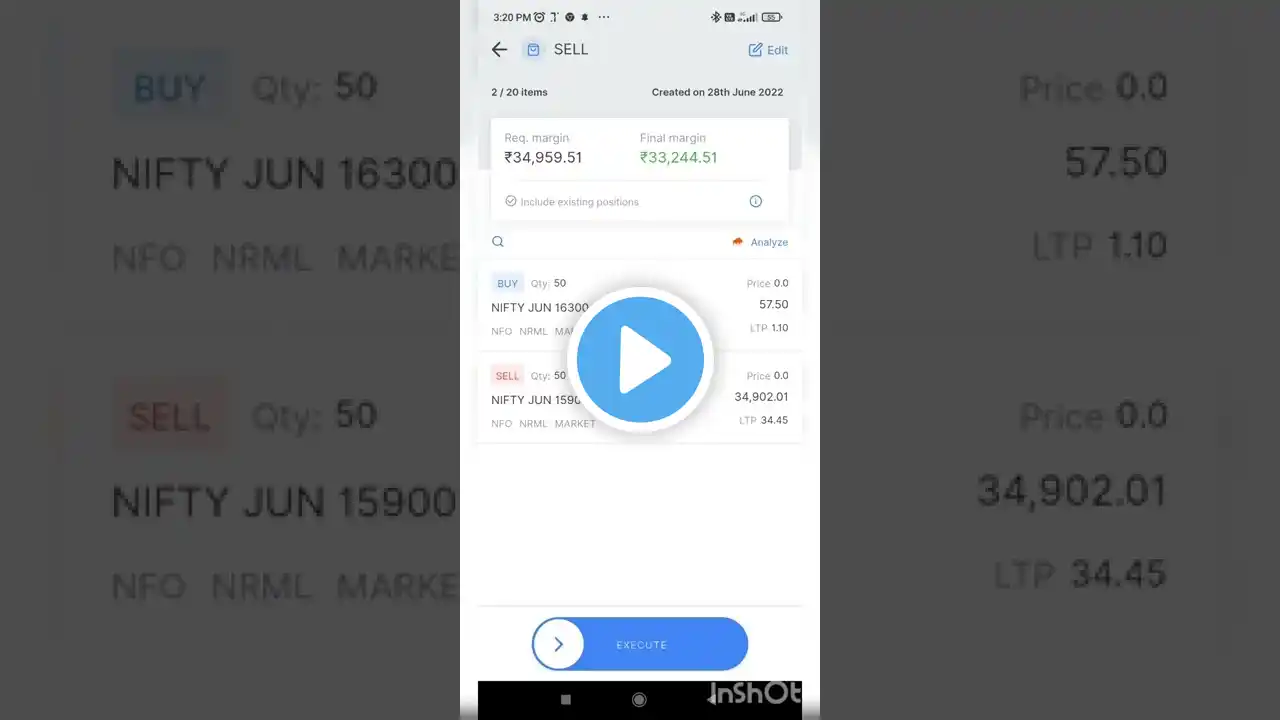

In this video, we continue our previous discussion on MTF – Margin Trading Facility and explain how MTF can be managed, aligned, and protected using Nifty 50 option buying strategies. I am Vikram Gupta, having more than 25 years of experience in Finance and Investments, and I am NISM registered. This video is specially designed for option buyers and investors working with limited capital who want to grow gradually while keeping capital protection as the first priority. 🔹 What you will learn in this video: • What is Margin Trading Facility (MTF) and how it works • MTF costs explained: • Delivery charges (approx. 2.5%) • Interest cost (₹50 per day per lakh, subject to broker terms) • How MTF shares are credited to your Demat account • Why MTF investors are eligible for: • Dividends (including interim dividends) • Bonus shares • Rights issues • Mergers & demergers (subject to margin adjustments) 🔹 MTF Benefits Explained: Even with partial payment, you become a registered shareholder of the company. This means you are eligible for almost all corporate actions, subject to completing required payments during events like demergers or rights issues. 🔹 Risk Awareness in MTF: Maintaining an MTF portfolio means exposure to market risk. There are two types of risks: • Systematic Risk (market-wide risks like war, FII selling, global news) • Unsystematic Risk (company-specific negative news or poor financial performance) 🔹 How to Protect an MTF Portfolio: As an option buyer, we can hedge the MTF portfolio using Nifty 50 options. Since Nifty 50: • Represents the Indian economy • Contains highly liquid and fundamentally strong companies • Acts as a global market indicator Using Nifty 50 option strategies, we can: • Hedge downside risk • Manage volatility • Focus on capital protection first, then profit and wealth creation 🔹 Why Only Nifty 50 Stocks for MTF: • High liquidity • Large-cap and stable businesses • Suitable for gradual wealth creation • Easier hedging through index options Stock selection, MTF portfolio structuring, and detailed hedging strategies will be discussed in upcoming videos. 🔹 Important Note: This journey is not about overnight profits or jackpots. It is about: • Discipline • Risk management • Capital protection • Gradual wealth creation over time (targeting 2026 and beyond) ⚠️ Disclaimer: This video is for educational purposes only. I am not giving any guarantee, assurance, or stock recommendation. Markets are risky, and results take time. Please understand the concepts, ask questions, and proceed cautiously. Stay connected, stay disciplined, and let’s learn how to protect capital while creating wealth—step by step. Thank you for watching. Capital Protection is our first priority. #MTF #MarginTradingFacility #Nifty50 #OptionBuying #CapitalProtection #RiskManagement #SystematicRisk #UnsystematicRisk #Hedging #PortfolioProtection #StockMarketIndia #ShareMarketLearning #OptionBuyers #BeginnerInvestors #WealthCreation