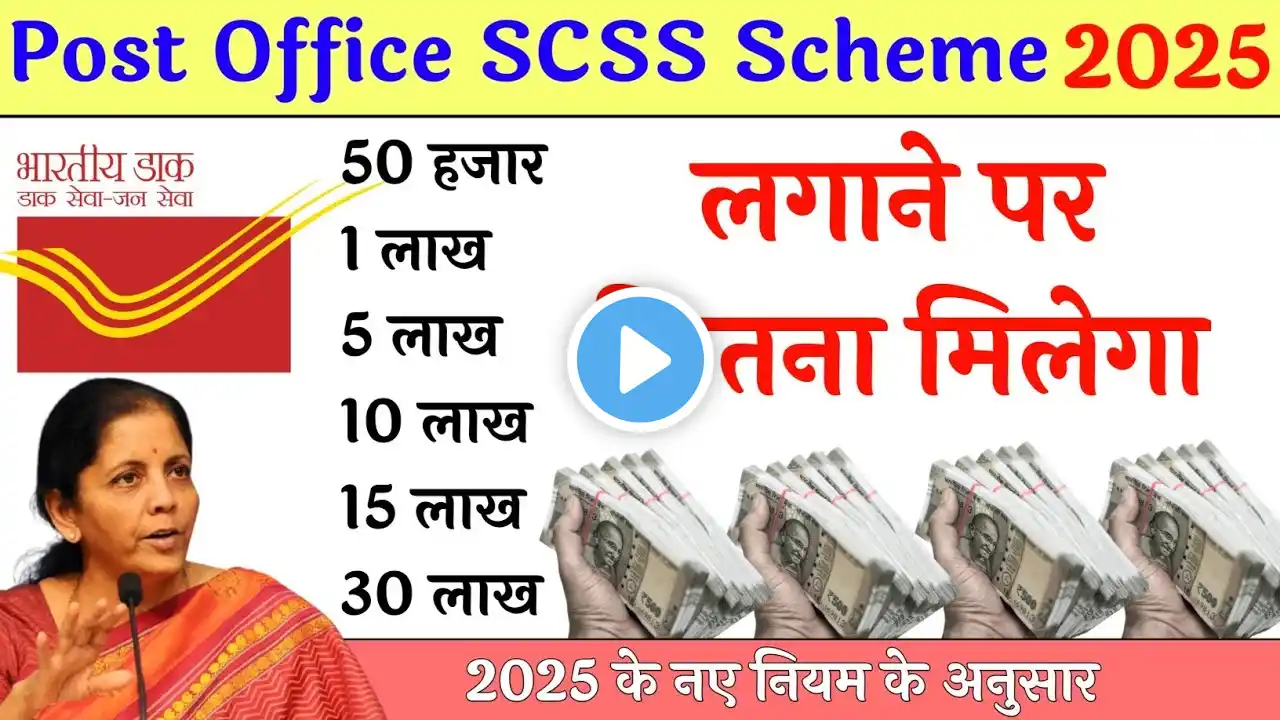

Post Office Senior Citizen Saving Scheme SCSS 2025 New Rules and New Interest Rate

Post Office Senior Citizen Saving Scheme (SCSS) 2025 | Latest Rules & Updated Interest Rate Welcome to our detailed video on the Post Office Senior Citizen Savings Scheme (SCSS) 2025, where we cover all the latest updates, new rules, and the revised interest rate applicable from 2025. If you’re a senior citizen or planning for a secure retirement, this scheme is one of the best government-backed options available in India. --- ✅ What is SCSS? The Senior Citizen Savings Scheme is a government-sponsored savings plan, specifically designed for individuals aged 60 years and above. It offers guaranteed returns and is one of the safest investment options for senior citizens, managed by India Post and available at authorized banks. --- 🔍 SCSS 2025 New Rules Highlights: Eligibility Age: 60 years and above. However, retirees from defense services aged 50 and above may also apply (subject to conditions). New Maximum Investment Limit (2025): ₹30 lakhs (increased from ₹15 lakhs in earlier years). Deposit Tenure: 5 years, extendable by 3 years. Account Type: Individual or joint (only with spouse). Premature Withdrawal: Allowed after 1 year, subject to penalty charges. Tax Benefits: Investments up to ₹1.5 lakh per annum are eligible for deduction under Section 80C of the Income Tax Act. --- 💰 SCSS Interest Rate 2025: The Government of India reviews interest rates quarterly. As per the latest announcement for 2025: Interest Rate: 8.20% per annum (payable quarterly). Interest is deposited directly into the account holder’s savings account. Safe, fixed, and unaffected by market volatility. --- 📈 Why Choose SCSS in 2025? Capital safety guaranteed by the Government of India. Higher interest rates compared to regular fixed deposits. Steady income through quarterly interest payouts. Tax benefits under Section 80C. Ideal for post-retirement income and financial independence. --- 📝 How to Open SCSS Account? Visit your nearest Post Office or authorized public/private sector bank. Submit identity, address, and age proof along with a duly filled SCSS application form. Deposit amount via cheque or cash. Account can be transferred between banks and post offices. --- 📢 Don't Miss Out! Stay informed and financially secure. This video covers everything you need to know about the Post Office SCSS Scheme 2025. Be sure to watch till the end for expert tips and real-time examples to help you decide if SCSS is the right choice for your retirement. --- 📌 Like | Share | Subscribe For more updates on Post Office schemes, FD rates, government saving plans, and financial advice – subscribe to our channel and hit the bell icon! #SCSS2025 #SeniorCitizenScheme #PostOfficeSchemes #InterestRate2025 #IndiaPost #SavingsScheme #TaxSavings #RetirementPlanning #GovernmentSchemes2025 #SCSSUpdate #SeniorCitizenSavings