Room for Error: The Most Underrated Part of Wealth (Psychology of Money Ch.13)

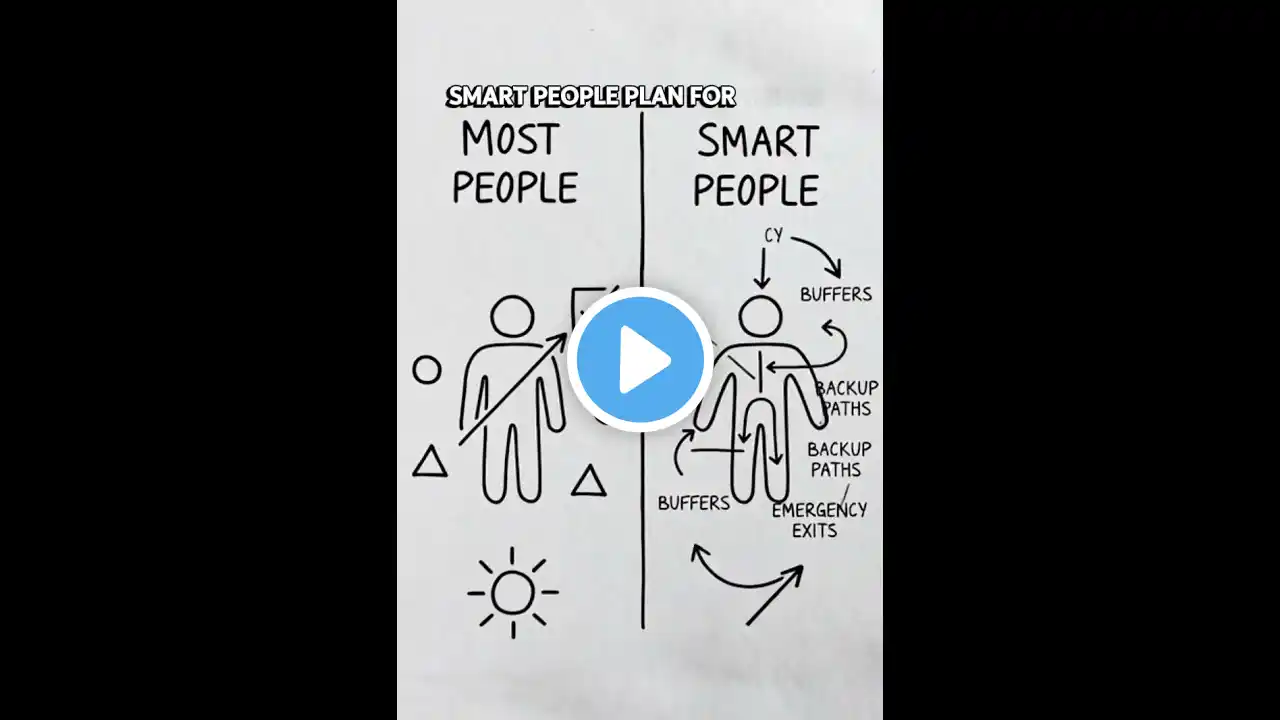

``` Can your budget survive a job loss? Can your portfolio survive a 50% crash? If not, you don't have room for error. And eventually, something will go wrong. Chapter 13 of "The Psychology of Money" by Morgan Housel: "Room for Error." Room for error is the gap between what could happen and what you can survive. It's the most underrated part of wealth building. In this breakdown: ✅ Why margin of safety matters more than optimization ✅ How much buffer you actually need ✅ Why most people plan for success (mistake) ✅ How room for error enables compounding Most people build plans that require everything to go right. Smart people build plans that survive when things go wrong. The difference is margin of safety. 📚 BOOK: "The Psychology of Money" by Morgan Housel 🎯 CHAPTER: 13 - "Room for Error" 💡 KEY INSIGHT: Room for error lets you survive long enough for compounding to work. 🔗 PREVIOUS CHAPTERS: [Links to Chapters 1-12] ⏭️ Comment "CHAPTER 14" for the next breakdown! 🎯 THE FRAGILITY TEST: Ask yourself: 1. Could I survive 6 months without income? 2. Could I watch my portfolio drop 50% without selling? 3. Could I handle a $5,000 emergency? 4. Could I handle a 20% income cut? 5. Could I take 6 months off to find a better job? 5 YES = Strong margin ✅ 0-2 YES = Fragile, build more buffer ❌ --- 🛡️ MINIMUM MARGINS YOU NEED: • Emergency Fund: 6-12 months expenses • Budget: Spend 70-80% of income (not 100%) • Investments: Handle 50% drop without panic • Housing: Payment 20-25% of income (not 30%+) • Debt: Payments under 15% of income Room for error doesn't just protect you. It enables compounding. Margin buys TIME. Time enables COMPOUNDING. Compounding creates WEALTH. --- 💬 QUESTION: On scale 1-10, how much room for error do you have? Drop your number below 👇 --- 👥 FOLLOW WEALTHMINDAI: @WealthMindAi ⚠️ DISCLAIMER: Educational content only. Not financial advice. Appropriate margins vary by individual. Consult a financial advisor. #wealthbuilding #realwaystomakemoneyfromhome #personalfinance #wealthbuilding #motivation #money 💬 COMMENT "CHAPTER 14" FOR NEXT BREAKDOWN! Chapter 14: "You'll Change" - Why your future self is a stranger 👍 LIKE if you're building more margin 🔔 SUBSCRIBE to finish this series 📤 SHARE with someone living on the edge 💬 COMMENT "CHAPTER 14" for next WealthMindAi ```