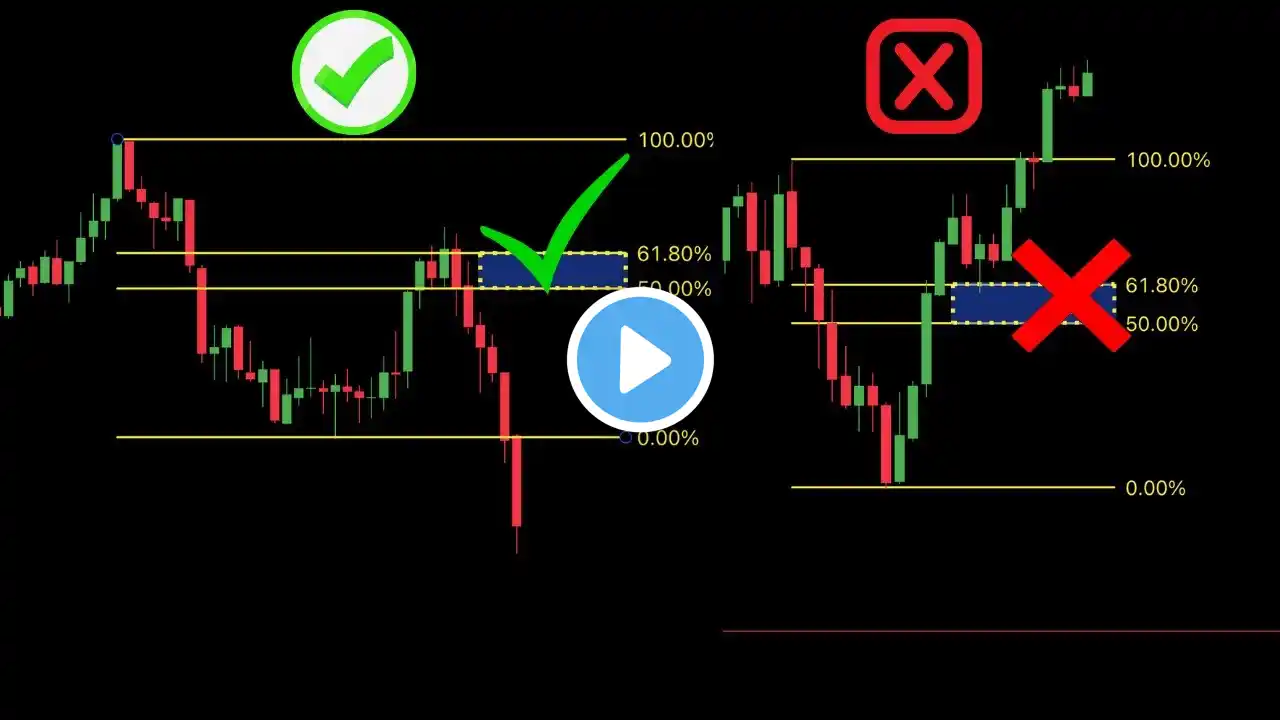

Fibonacci Retracement Explained | How to Use Fib for Trading Entries

🔥 About This VideoAre you struggling to find precise entry points after a market pullback? The Fibonacci Retracement tool is one of the most powerful technical analysis indicators used by professional traders to find high-probability support and resistance levels.2In this comprehensive tutorial, we break down exactly how to use the Fibonacci Retracement tool on any chart (stocks, crypto, forex, futures). You'll learn the crucial steps for drawing it correctly, understanding the key "golden" levels, and integrating it into your existing trading strategy to maximize profit potential.🔑 What You Will Learn (Timestamps)Use these timestamps to help viewers navigate and for better SEO!0:00 | Introduction: The Power of Fibonacci1:15 | What is the Fibonacci Sequence and the Golden Ratio?2:45 | How to Draw the Fibonacci Retracement Tool (Crucial Step!)4:30 | The Most Important Fibonacci Levels (The $61.8\%$ and $38.2\%$ Secrets)6:50 | Trading Strategy: Using Fib Retracements for Entry Points9:10 | Using Fibonacci with Other Indicators (Confirmation)10:45 | Summary & Next Steps✅ Key TakeawaysLearn the one mistake almost everyone makes when drawing the Fib Retracement.Understand why the $0.618$ and $0.382$ ratios are so critical in financial markets.How to confirm a Fib level with candlestick patterns or volume.The difference between a shallow pullback and a major trend reversal.