Groww Lower circuit | what to do in Groww | Groww IPO | Groww short selling | sellers trapped

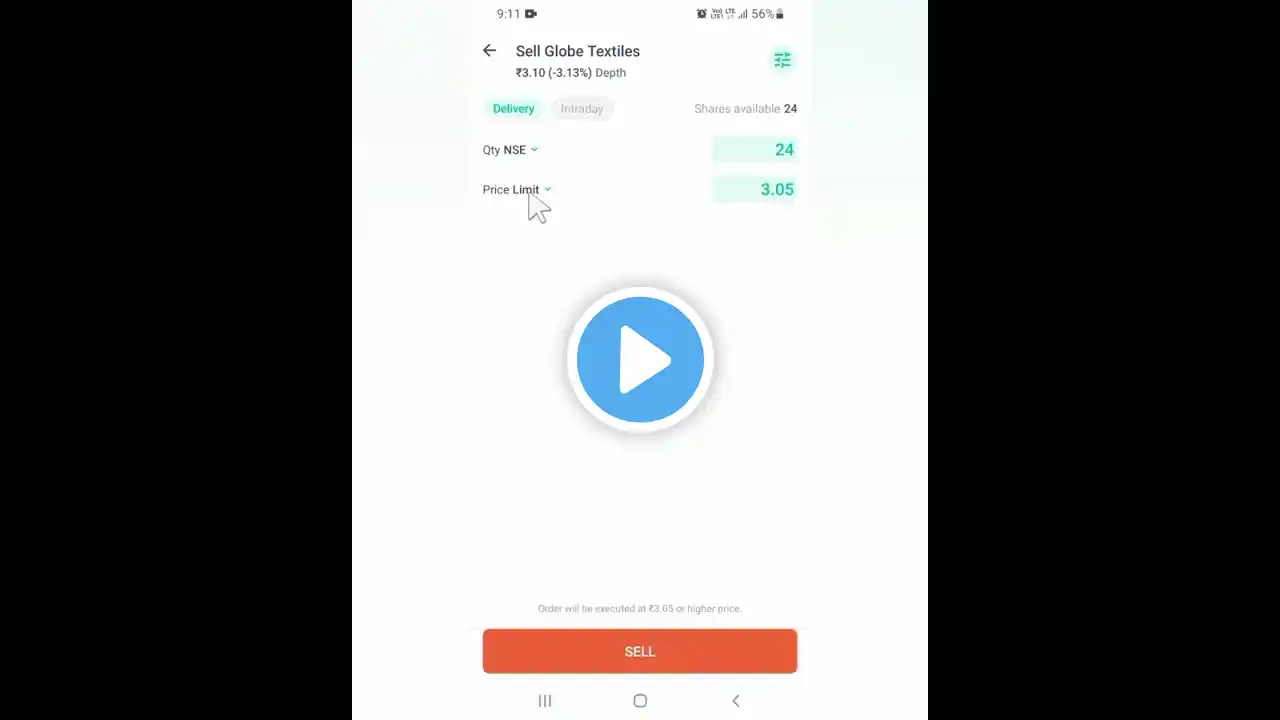

Follow for more real-time updates: ▶️ Join our FREE telegram channel One can join with link below or search "moneycreatesmoney" in telegram https://t.me/moneycreatesmoney ▶️ Follow me on Twitter: https://twitter.com/nakulvibhor?s=09 The Groww stock created massive buzz after closing 10% down in a lower circuit on 19th November, leaving retail traders confused and sellers trapped. In this detailed video, we break down exactly what happened, why the stock fell sharply after a heavy rally, how short sellers got caught in a trap, and what investors and traders should do next. If you're holding Groww shares, planning to buy, or simply trying to understand the volatility, this video gives you complete clarity. 1. Groww IPO – Quick Summary Groww’s parent company recently made its debut in the Indian stock market with strong demand and a healthy premium listing. The IPO was one of the most discussed fintech offerings, backed by rapid growth in user base, strong financial traction, and rising broking market share. The company is positioned as one of India’s fastest-growing brokerage and wealth-tech players. Post-listing, the stock witnessed intense interest from both long-term investors and short-term traders due to low free float, high demand, and strong brand recall. 2. Why Groww Hit a 10% Lower Circuit on Nov 19 On November 19th, the stock locked in a 10% lower circuit following an extended rally. Several factors contributed to the sudden fall: Profit-booking after sharp multi-day gains High volatility created by low float and increased speculative trading Heavy short-selling attempts, expecting correction after the strong rally Auction pressure and delivery mismatch from previous sessions Market participants adjusting positions ahead of expected volatility This wasn’t a fundamental fall, but mainly a technical and sentiment-driven correction. 3. Short-Selling Trap Explained Groww recently became a high-action stock due to aggressive intraday short-selling. Many traders shorted the stock expecting a correction, but a sudden price spike earlier had already pushed short-sellers into a trap. This resulted in: Delivery shortages Forced buying at higher prices Auction penalties for short-sellers Panic exits On Nov 19, the pressure flipped: unresolved positions, margin issues, and delivery mismatch intensified the downmove - creating a classic short-seller trap + lower circuit combo. 4. Are Sellers Still Trapped? Yes - many intraday short-sellers and delivery short positions remained stuck: Short-sellers couldn’t square off as the stock froze at the lower circuit Forced auction settlements continued Penalties added extra losses Lower circuit prevented any meaningful exit This is why Groww became a trending topic, with retail traders caught in the volatility and unable to exit positions. 5. What Should Traders Do Now? If You Are a Trader: Avoid chasing moves in a stock hitting circuits. Wait for the circuit to open before taking fresh positions. Don’t short a stock with low float and heavy retail activity — trap risk is high. Track auction notices, delivery updates, and margin requirements. Use strict stop-losses if trading after the circuit opens. If You Shorted Groww: Prepare for forced settlement and possible penalties. Avoid adding fresh shorts till volatility cools. Manage risk tightly — trapped positions can inflate losses quickly. 6. What Should Investors Do? Long-term Investors: The long-term story of the company remains unchanged. Volatility during early listing days is normal due to price discovery. If you believe in the fintech growth story, use dips to accumulate gradually. Don’t panic sell based purely on a lower circuit day. New Investors: Wait for stability. Focus on fundamentals, not just listing momentum. Track quarterly performance and user base growth. 7. Why Groww Will Remain Volatile Low free float Heavy retail participation Strong brand visibility attracting traders Weak hands exiting on dips, strong hands buying on corrections Continuous short-covering cycles Auction & delivery pressures These factors ensure that the stock will remain high-volatility for the next few weeks. 8. Final Verdict Groww hitting a 10% lower circuit on Nov 19 was a technical event, not a fundamental breakdown. Traders must be cautious, while long-term investors should stay focused on the company’s overall growth trajectory. This phase is part of normal price discovery after a high-demand IPO. If you're invested in Groww or planning to buy, this video will guide you through every important detail — from IPO outlook to trading psychology, from lower circuits to seller traps, from short-selling mechanics to actionable steps. #Groww #GrowwIPO #GrowwLowerCircuit #GrowwStock #GrowwAnalysis #GrowwShortSelling #SellersTrapped #FintechStock #IPOReview #StockMarketIndia #LowerCircuit #TradingStrategy #InvestingTips #RetailInvesting #MarketCrash #ShortSqueeze #GrowwApp #IndianStockMarket #VibhorVarshney