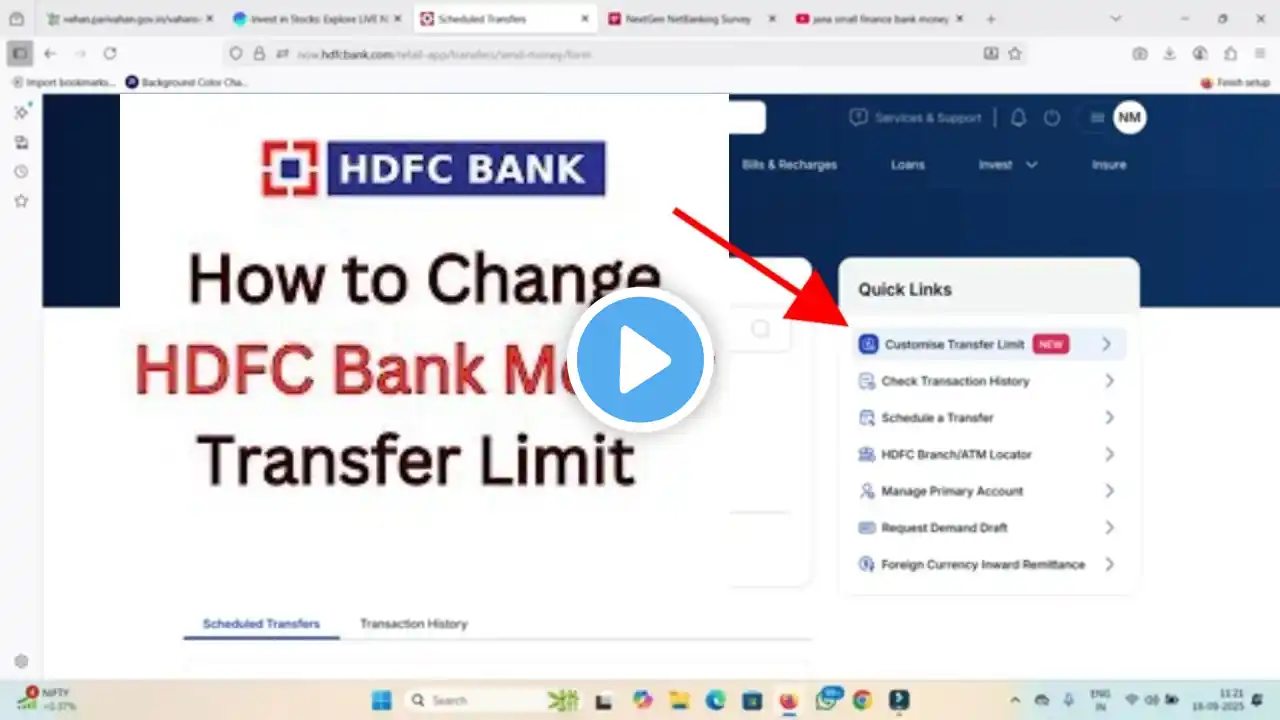

How to change daily transfer limit in NEW version hdfc netbanking | hdfc fund transfer limit change

Here’s how you can change or increase the fund-transfer |Third Party Transfer = TPT limit in HDFC Bank. If you tell me if you want NetBanking or Mobile App steps, I can send that too. Meanwhile, here are the general ways: --- ✅ What is the TPT Limit TPT = Third Party Transfer Limit for transfers to other bank accounts or other people’s accounts . The maximum you can set currently is ₹50,00,000| 50 lakh . If you’re above 70 years old, you can only increase up to ₹10,00,000 via online; beyond that you’ll likely need to go to a branch. --- 🔧 How to Change / Increase the Limit Via NetBanking | Online 1. Log in to your HDFC NetBanking account. 2. Go to Funds Transfer tab. 3. Select Modify TPT Limit or Customise Transfer Limit. 4. Choose the amount you want |up to ₹50 lakh, subject to eligibility. 5. Authenticate the change via OTP sent to registered mobile and/or using your Debit Card details. 6. Once updated, the new limit becomes effective for many customers immediately. Offline / Branch Option If for some reason you can’t increase online e.g. need higher than what’s allowed online, age restrictions, etc., you can go to your nearest HDFC branch. Fill out the TPT Limit Increase form and submit with a valid photo ID. --- ⚠ Other Important Things to Know When you add a new beneficiary, for first 24 hours, transfer to that beneficiary is limited to ₹50,000 only in full or in parts. After 24 hours from beneficiary activation, you can transfer up to your set TPT limit. UPI limits are regulated by NPCI and cannot be increased beyond those standard limits.