Trail Balance and Rectification of errors in Kannada. I puc Karnataka | class 11. very easy

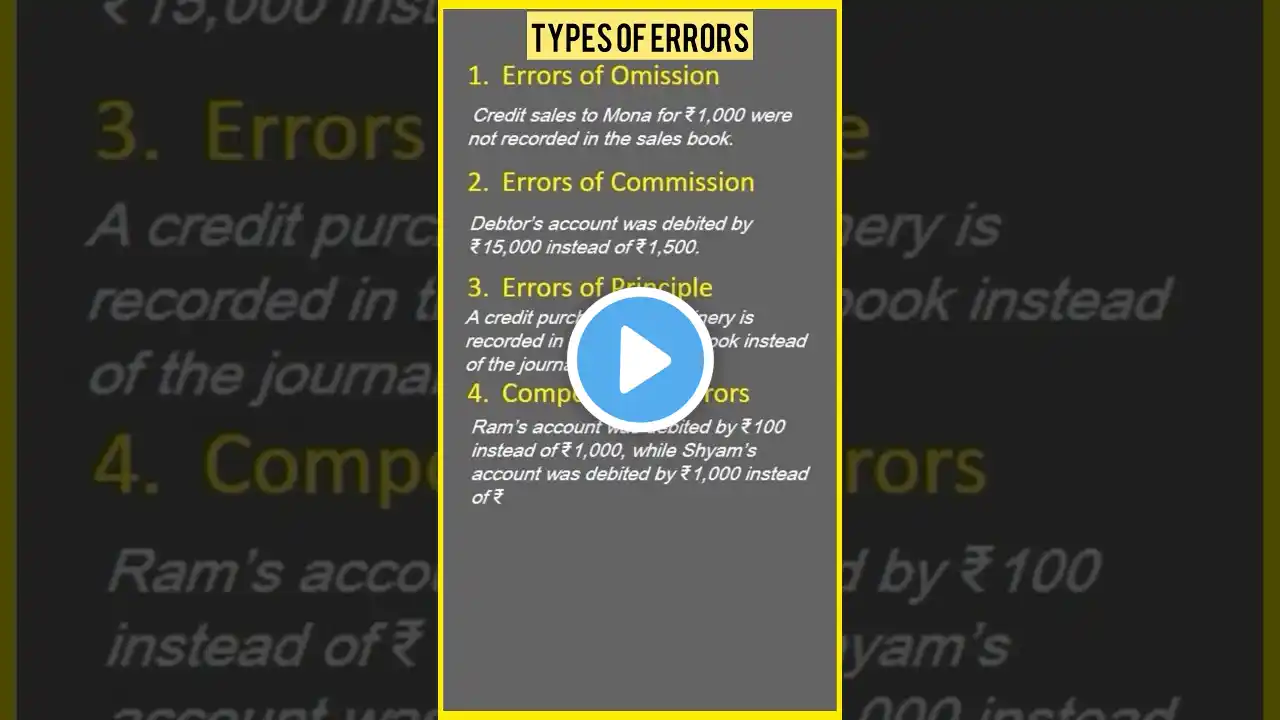

Give me information about trail balance and rectification of errors in 1000 worlds Trial Balance A trial balance is a statement prepared to ensure that the ledger accounts' debit and credit balances are equal. It is an essential part of the accounting process, serving as a checkpoint to confirm that all accounting entries are mathematically accurate and properly recorded. The trial balance is prepared at the end of an accounting period before financial statements are compiled. Objectives of Trial Balance: Check Arithmetic Accuracy: Ensures the total debits equal the total credits. Facilitate Financial Statements: Provides a foundation for preparing the income statement and balance sheet. Error Detection: Helps identify discrepancies in the ledger accounts. Format of Trial Balance: The trial balance is presented in a tabular format with three columns: Account Name: Lists all the ledger accounts. Debit Balance: Displays balances of all accounts with debit nature (e.g., assets, expenses). Credit Balance: Displays balances of all accounts with credit nature (e.g., liabilities, income). Account Name Debit (₹) Credit (₹) Cash 50,000 - Accounts Payable - 20,000 Revenue - 80,000 Expenses 30,000 - Total 80,000 80,000 Limitations of Trial Balance: Does Not Detect All Errors: Some errors, such as compensatory errors or errors of omission, may not be revealed. Does Not Confirm Accuracy of Accounts: It only ensures mathematical accuracy, not the correctness of transactions. Fails to Highlight Fraud: Fraudulent entries may balance out and go undetected. Rectification of Errors Errors in accounting are inevitable and may occur during the process of recording, classifying, or summarizing financial transactions. Rectification of errors is the process of identifying and correcting these errors to ensure the accuracy of the financial statements. Types of Errors: Errors of Omission: A transaction is either partially or entirely omitted. Example: A sales invoice is not recorded in the books. Errors of Commission: Entries are made incorrectly concerning amount, account, or posting. Example: Posting ₹500 to the wrong account. Errors of Principle: Violates fundamental accounting principles. Example: Treating a revenue expense as a capital expense. Compensating Errors: Errors cancel each other out. Example: Overstating one account and understating another by the same amount. Clerical Errors: Arithmetic errors in addition, subtraction, or posting. Process of Rectification: Identify the Error: Review the ledger and source documents to detect discrepancies. Classify the Error: Determine the type and nature of the error. Rectify through Journal Entries: Record adjustment entries to correct errors. Rectification in Different Situations: Before Preparation of Trial Balance: Errors are rectified by correcting the affected accounts directly. After Preparation of Trial Balance: Errors require journal entries to adjust the balances in the accounts. Example: Error: Wages paid ₹10,000 is debited to Salaries Account. Rectification Entry: Wages Account Dr. 10,000 To Salaries Account 10,000 After Final Accounts Are Prepared: If errors are found after financial statements, they are corrected in the subsequent accounting period, often by adjusting the profit and loss account or reserves. Example of Error Rectification: Error: Sales of ₹5,000 to Mr. A are posted to Mr. B's account. Rectification Entry: Mr. A Account Dr. 5,000 To Mr. B Account 5,000 Conclusion The trial balance ensures the mathematical accuracy of ledger accounts and aids in preparing financial statements. However, it cannot detect all types of errors. The process of rectification is essential to correct errors and maintain accurate financial records. Together, these concepts form the backbone of accurate and reliable accounting practices.