The Psychology of Money — 19 Lessons to Think Richer (7-Minute Book Summary)

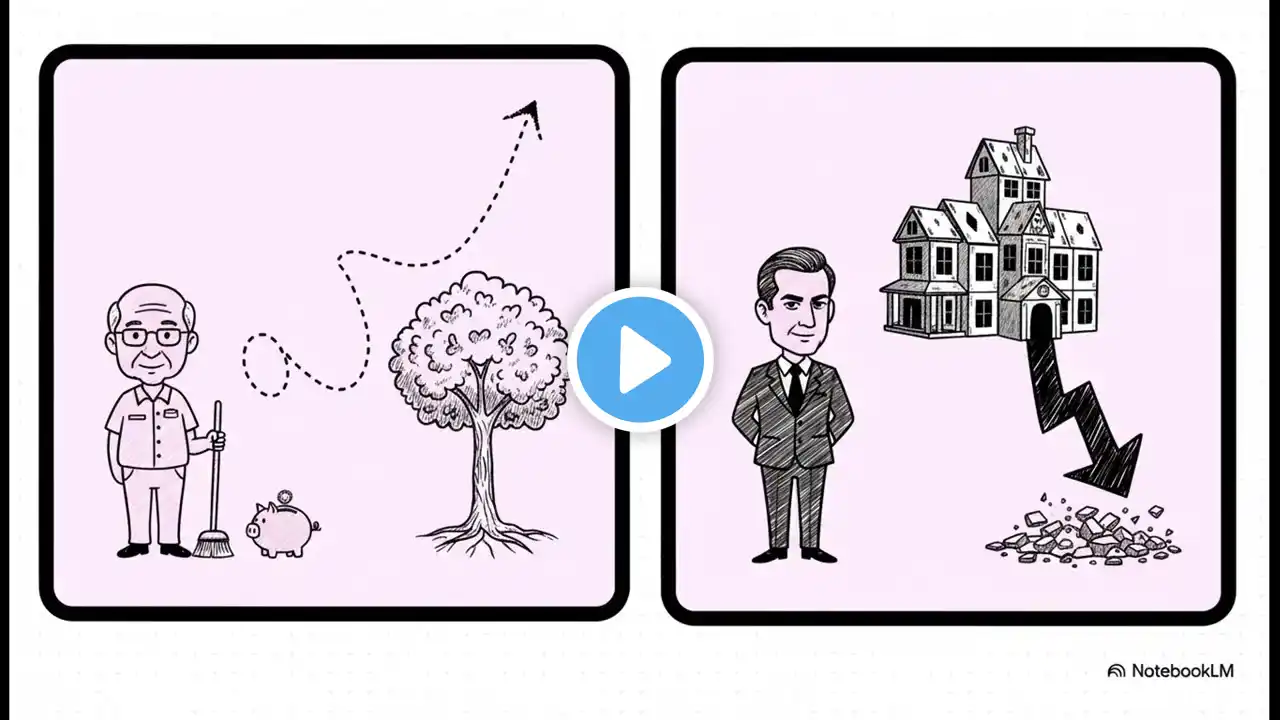

💸 Thought Quote: "Spending money to show people how much money you have is the fastest way to have less money." — Morgan Housel 🧠 Puzzle: You have $1,000. Option A: Invest and wait 10 years. Option B: Spend it on something impressive today. Which gives you more freedom? Comment your logic! 😂 Joke: Why did the dollar bill break up with the penny? It said, "You're just not making cents anymore." The behavior around money matters more than raw IQ. In 7 minutes, we unpack Morgan Housel’s 19 short stories: room for error, freedom over status, save more than is “optimal,” and why reasonable beats rational for most humans. • Housel’s core thesis and essay roots at Collaborative Fund. • Recent interviews underline spending for regret-minimization and meaning. Educational summary; not financial advice. ✨ WHAT YOU'LL MASTER: ✅ Why Behavior Beats IQ: Money success isn't about being smart—it's about how you behave with money, controlling emotions, and making reasonable (not rational) decisions ✅ Room for Error: Building financial buffers and planning for uncertainty to survive unexpected events and market volatility ✅ Freedom Over Flexing: The real wealth goal is controlling your time, not impressing others with expensive status symbols ✅ Tail Events Win: Understanding that a few huge wins matter more than many small successes in investing and wealth-building ✅ Saving Without Purpose: Why saving for flexibility beats saving for specific goals—financial independence gives you options ✅ Regret Minimization: Spending money on experiences and things that truly matter to you, not what society values 🎯 WHO THIS VIDEO IS FOR: • Young professionals starting their financial journey • Anyone struggling with money despite good income • Investors who want to understand market psychology • People interested in behavioral finance and decision-making • Those seeking financial independence and freedom • Readers of personal development and wealth-building books • Anyone who wants to think richer, not just earn more 💡 KEY LESSONS FROM MORGAN HOUSEL: • Wealth is what you don't see (money not spent) • Compounding works when you give assets time • Your personal experiences shape your money beliefs • Luck and risk are two sides of the same coin • Use money to buy time and control over your life • Optimism with paranoia: be hopeful but prepared • Define "enough" to avoid the hedonic treadmill 📚 ABOUT THE PSYCHOLOGY OF MONEY: Morgan Housel's The Psychology of Money is a Wall Street Journal and New York Times bestseller that has sold millions of copies worldwide. Published in 2020, the book challenges conventional financial advice by focusing on behavior and psychology rather than technical knowledge. Housel, a partner at The Collaborative Fund and former columnist at The Wall Street Journal and The Motley Fool, uses 19 short stories to illustrate timeless lessons about wealth, greed, and happiness. The book has become essential reading for anyone interested in personal finance, investing, and behavioral economics. 🔗 RELATED FINANCIAL CONCEPTS: • Behavioral finance and cognitive biases • Financial independence retire early (FIRE) movement • Wealth building strategies and passive income • Investment psychology and market timing mistakes • Minimalism and intentional spending • Long-term vs short-term thinking • Compound interest and time value of money ✍️ ABOUT HOW I MET YOUR MARGIN: We create actionable 7-minute book summaries on personal finance, psychology, self-improvement, strategy, and consciousness. Our mission: help you learn faster, think deeper, and apply wisdom immediately. Subscribe for weekly breakdowns of bestselling books and timeless classics that upgrade your life. 👍 TAKE ACTION: • LIKE if this changed how you think about money • SUBSCRIBE for weekly book summaries • COMMENT your biggest money lesson or question • SHARE with someone who needs smarter money habits Chapters 00:00 Hook — money isn't math, it’s behavior 00:22 What this book actually covers (19 stories) 01:00 Reasonable over rational (why rules must fit your life) 02:00 Room for error & planning for surprise 03:20 Freedom (control your time beats flexing status) 04:40 Tails you win (outlier returns & patience) 05:50 Spend for regret-minimization & meaning 06:50 Starter plan & next video #PsychologyOfMoney #MorganHousel #PersonalFinance #BehavioralFinance #MoneyMindset