In Your 50s? Do This Now and Retire Before 60

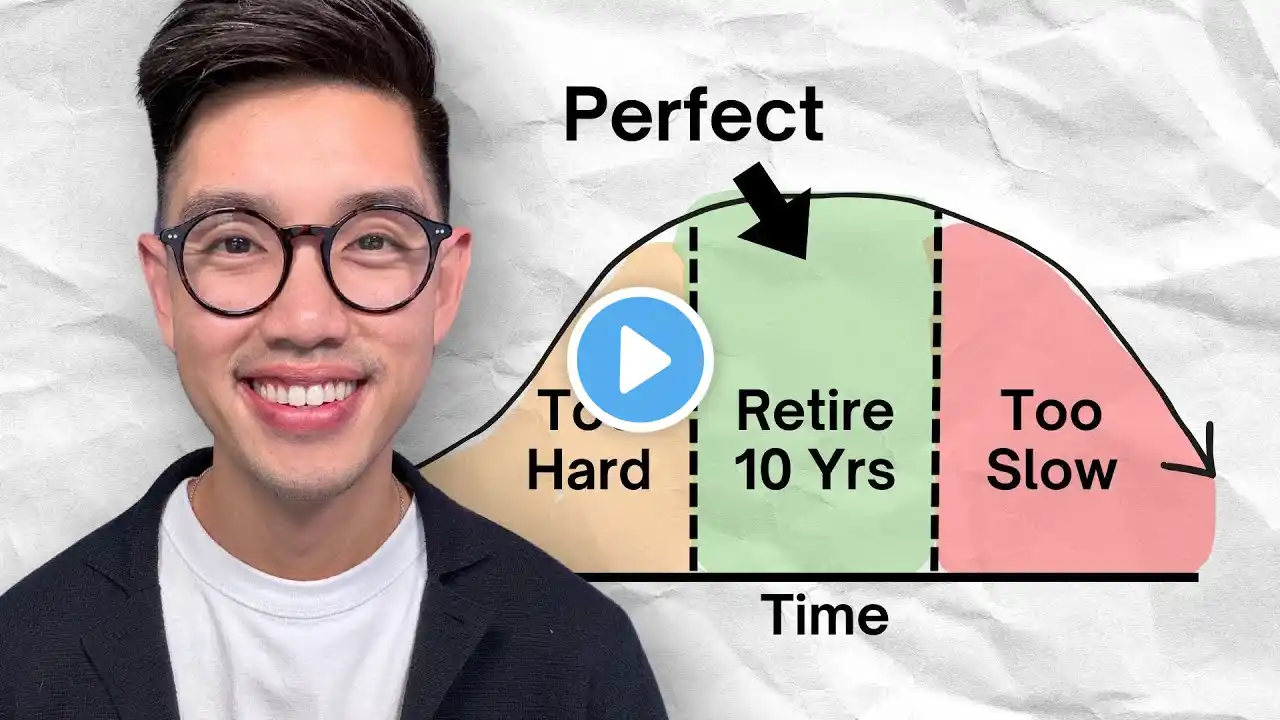

Retiring before age 60 isn’t about luck — it’s about following the right financial playbook. In this video, we break down the real strategies early retirees use to leave work years sooner, including how to eliminate debt, create predictable income, build cash reserves, and use the “Golden Window” for powerful tax planning. You’ll learn why bad debt is the #1 barrier to early retirement, how to determine your true “lifestyle number,” and why testing your budget in your 50s can reveal hidden gaps before you leave the workforce. We also discuss how to build a reliable paycheck in retirement using cash reserves and bond ladders so you’re not forced to sell investments during market downturns. Early retirees also need a healthcare bridge before Medicare at 65 — and we explain how ACA subsidies, HSAs, COBRA and taxable-income control can help reduce costs. Plus, you’ll discover how Roth conversions and capital-gain harvesting during the low-income “Golden Window” can significantly reduce lifetime taxes. Finally, retirement success isn’t just about money — it’s about purpose. We cover how the happiest early retirees plan not just their finances, but their next chapter in life. If you’re dreaming about early retirement, this is your roadmap. Are you in your 50s dreaming of early retirement? This video presents a practical 10-point retirement checklist, emphasizing that financial planning is about a concrete plan, not luck. Discover key steps for budgeting, building bridges to secure your future, and designing a fulfilling life after retirement. We also highlight the importance of avoiding credit card debt and utilizing strategies like a bond ladder strategy for robust financial management.