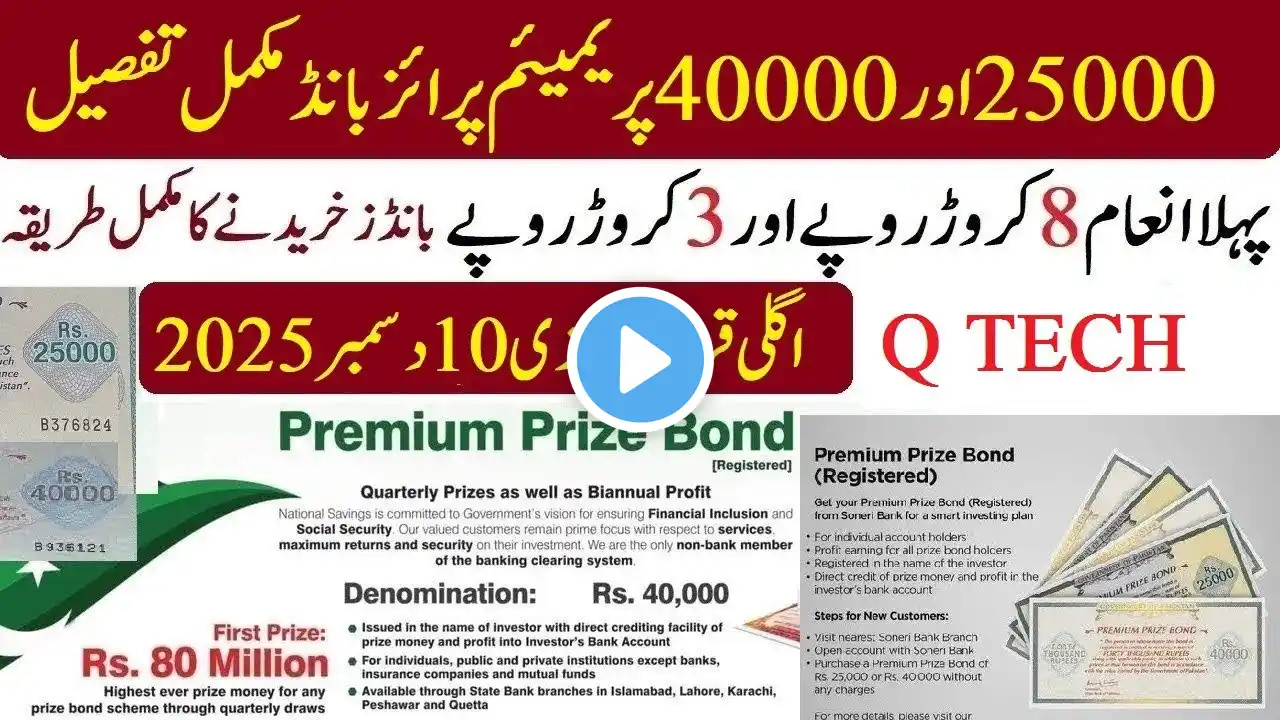

Premium Prize Bonds | Investment Guide for Beginners

Premium Prize Bonds are currently available in two denominations I.e Rs.25000 and Rs.40000. These Bonds have different attributes as compared to bearer prize bonds. Some of their characteristics are as below 1. These Bonds are registered on investment name against their CNIC 2.These Bonds yields include proze money as well as profit. The investor's need to provide their bank account while investment that is linked with the prize Bond. 3. The prize money need not to be claimed as its directly credited to the linked bank account. 4.semiannual profit at 5.1% is provided which may change with time to time 5. These Bonds can be pledged as a security and loan can be taken from the commercial banks. 6.Zakat not applicable 7.WHT applicable as per prevailing rate. Currently for filer the rate of tax on prize money is 15% and for Non filer it is 35% 8. These Bonds can not be sold in open market rather they can be transferred to any other person name by visiting the banks where from these Bonds were purchased 9.for Prize on Rs.40000 as as below First Prize Rs.80 Million(1) 2nd Prize Rs.30 Million (3) 3rd Prize Rs.5 lacs(660) Prize details for Rs.25000 1st Prize 30 Million(2) 2nd Prize 10 Million(5) 3rd Prize Rs.3 lacs(700) Authorised branches list where you can buy premium Prize Bonds https://www.sbp.org.pk/sbp_bsc/PrizeB...