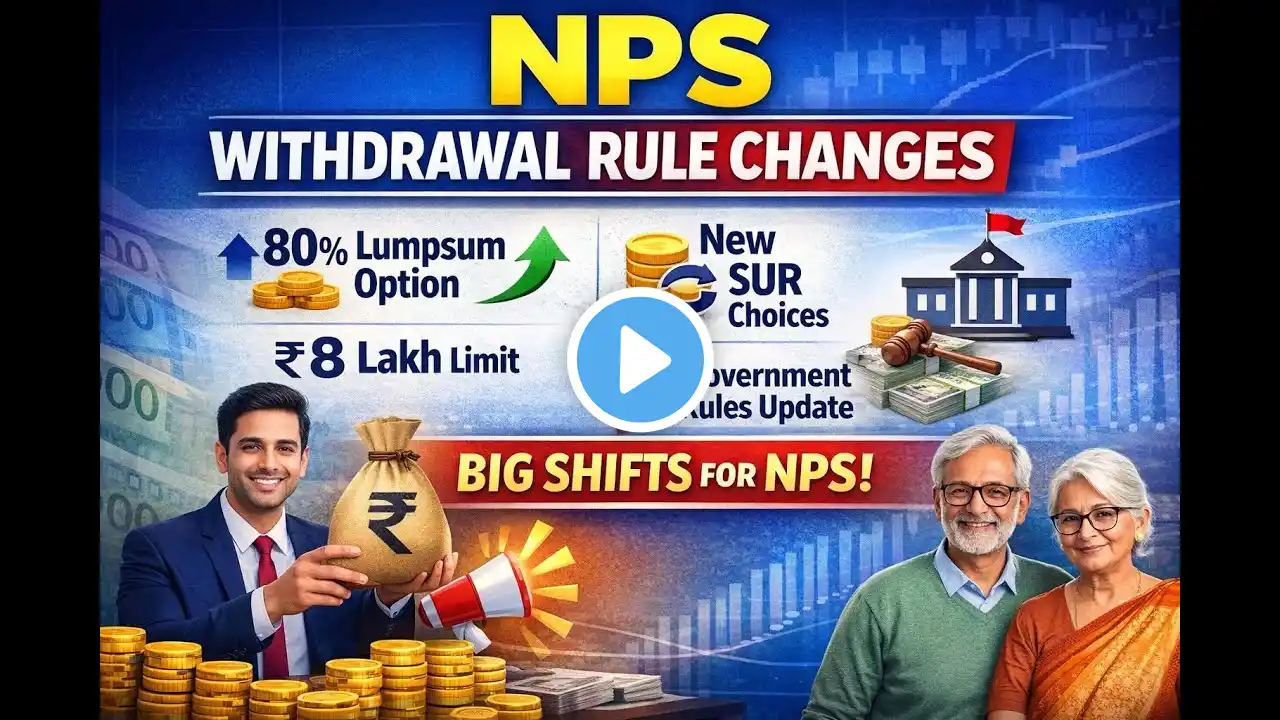

NPS New Rules 2025 | Withdraw More, Annuity Less – Full Breakdown

Description: The latest PFRDA amendments have introduced major changes to NPS withdrawal limits and annuity requirements, giving subscribers greater flexibility and control over their retirement savings. In this video, we explain: ✅ New lumpsum vs annuity ratios ✅ Increased 100% withdrawal thresholds ✅ Special rules for Non-Government, Government, NPS-Lite, and subscribers joining after age 60 ✅ Introduction of SUR (Systematic Unit Withdrawal) and SLW ✅ Changes in partial withdrawals, medical withdrawals, and lien on corpus 🔹 Key Highlights: Up to 80% lumpsum withdrawal for Non-Government subscribers 100% withdrawal limit increased to ₹8 lakh (and ₹12 lakh in some cases) Greater flexibility for nominees and senior citizens New alternatives to traditional annuity options 📌 These changes aim to make NPS more subscriber-friendly, flexible, and aligned with modern retirement needs. 👉 Watch till the end to understand how these rules may impact your retirement planning. 🔔 Subscribe for simple explanations on NPS, retirement planning, and personal finance updates. 👍 Like & Share this video to help others stay informed. Disclaimer: This video is for informational purposes only. Rules are based on current PFRDA guidelines and may change. Please consult official sources or a financial advisor before making decisions. #NPS #NPSWithdrawal #PFRDA #RetirementPlanning #Pension #NPSRules #PersonalFinance #IndiaFinance