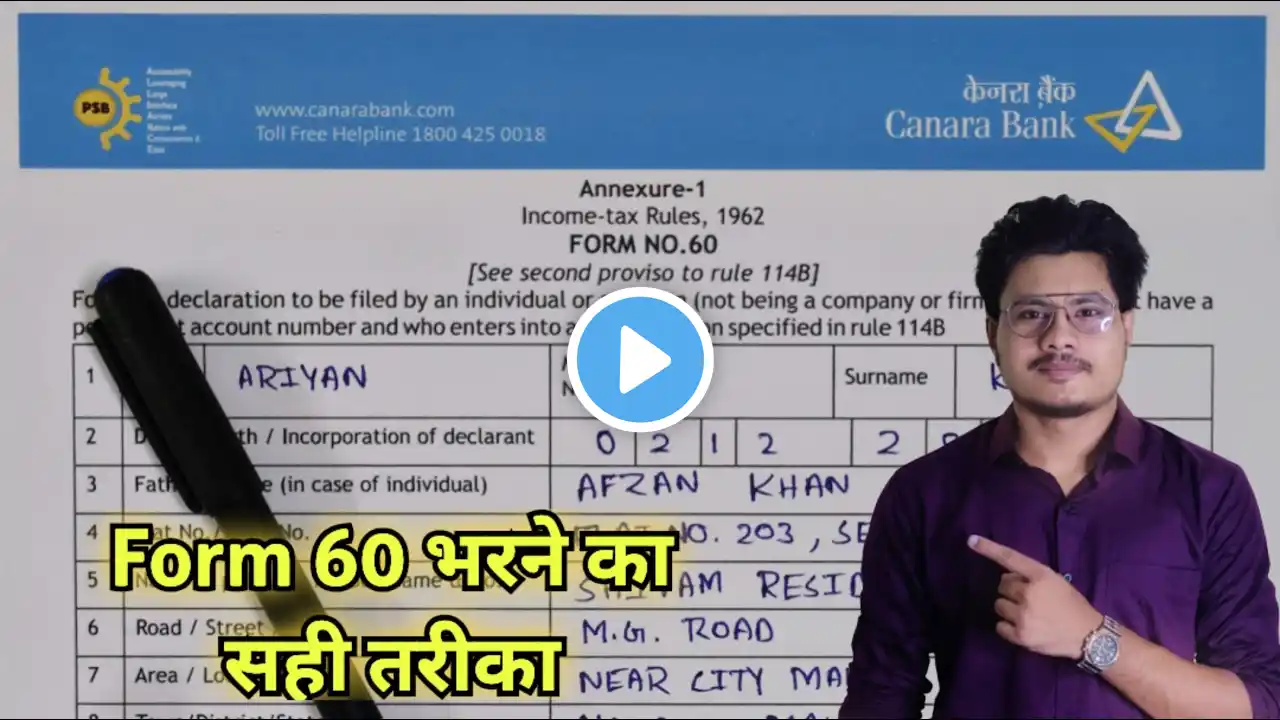

Canara Bank Form 60 Fill Up & Document List | PAN Card Alternative Form

Hi guys, this is Ariyan. In this video, I’ve explained the complete Canara Bank Form Fill Up Process in detail. Many people get confused when the bank asks for Form 60, especially during account opening or any big transaction. So in this video, I’ve clearly explained what Form 60 is, when it is needed, and how to fill it up step by step. I’ve also shown which documents you need to attach while submitting the form in Canara Bank. According to Rule 114B of the Income Tax Rules, 1962, Form 60 is required when a person does not have a PAN card but wants to do certain financial transactions. Some common cases where Form 60 is needed include: ➡️ When opening a new bank account (other than time deposits below ₹50,000). ➡️ For making a fixed deposit exceeding ₹50,000 or aggregate deposits above ₹5 lakh in a financial year. ➡️ For purchase or sale of immovable property valued at ₹10 lakh or more. ➡️ When applying for a debit card, credit card, or loan. ➡️ For purchase of motor vehicle (other than two-wheeler). ➡️ When making cash deposits exceeding ₹50,000 in a single day. ➡️ For cash payment of hotel bills, foreign travel, or mutual fund investments above prescribed limits. If you don’t have a PAN card and still want to complete any of these transactions, Form 60 becomes compulsory. That’s why I’ve also shared the real cases where Canara Bank asks for Form 60 and common mistakes people make while filling it. If you have any doubt, you can reach me directly on Instagram DM – 👉 https://instagram.com/ariyan.srk13?ut... #CanaraBank #Form60 #BankFormFillUp #AriyanExplains #BankingAwareness #FinanceEducation #MatureTad