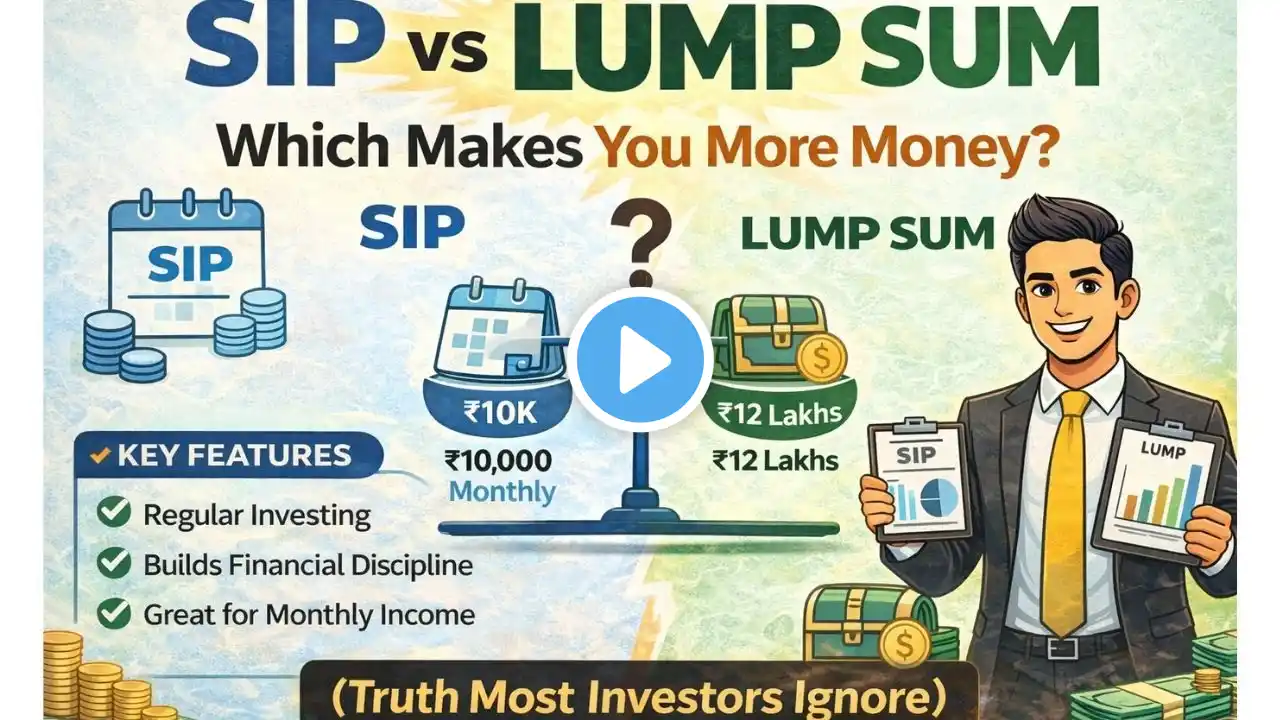

SIP vs Lump Sum: Which Makes You More Money? (Truth Most Investors Ignore)

Most investors ask one question again and again: 👉 Should I invest through SIP or Lump Sum? In this video, we break down SIP vs Lump Sum investing using a real 10-year comparison, simple logic, and practical financial planning insights. 📊 What you’ll learn in this video: ✔ What SIP (Systematic Investment Plan) really does for your money ✔ Why lump sum investing shows higher returns in some cases ✔ The hidden risk of market timing most people ignore ✔ Who should choose SIP and who should invest lump sum ✔ How to use both strategies together for smarter wealth creation 💡 Key takeaways: SIP builds discipline and protects you from bad market timing Lump sum maximizes compounding when done at the right time The best investors don’t choose one — they use both wisely This video is perfect for: Beginners in mutual funds Salaried individuals starting SIPs Investors confused between SIP and lump sum Anyone planning long-term goals like retirement or wealth creation 📌 Remember: Wealth is not built by timing the market — it’s built by time in the market. 🔔 Subscribe to Wealth & Future For simple, practical, and honest financial education that helps you build a better future. 💬 Comment below: Are you investing through SIP, lump sum, or both? 👍 Like | 🔁 Share | 📩 Save for later #incometaxindia #news #investingforbeginners #AIS #SFT #taxawareness #itr #finance #investment #pms #stockmarket #stocks #sip #financialplanning #mutualfunds #wealthbuilding #personalfinance #sipplanning #moneymanagement #moneymanagement