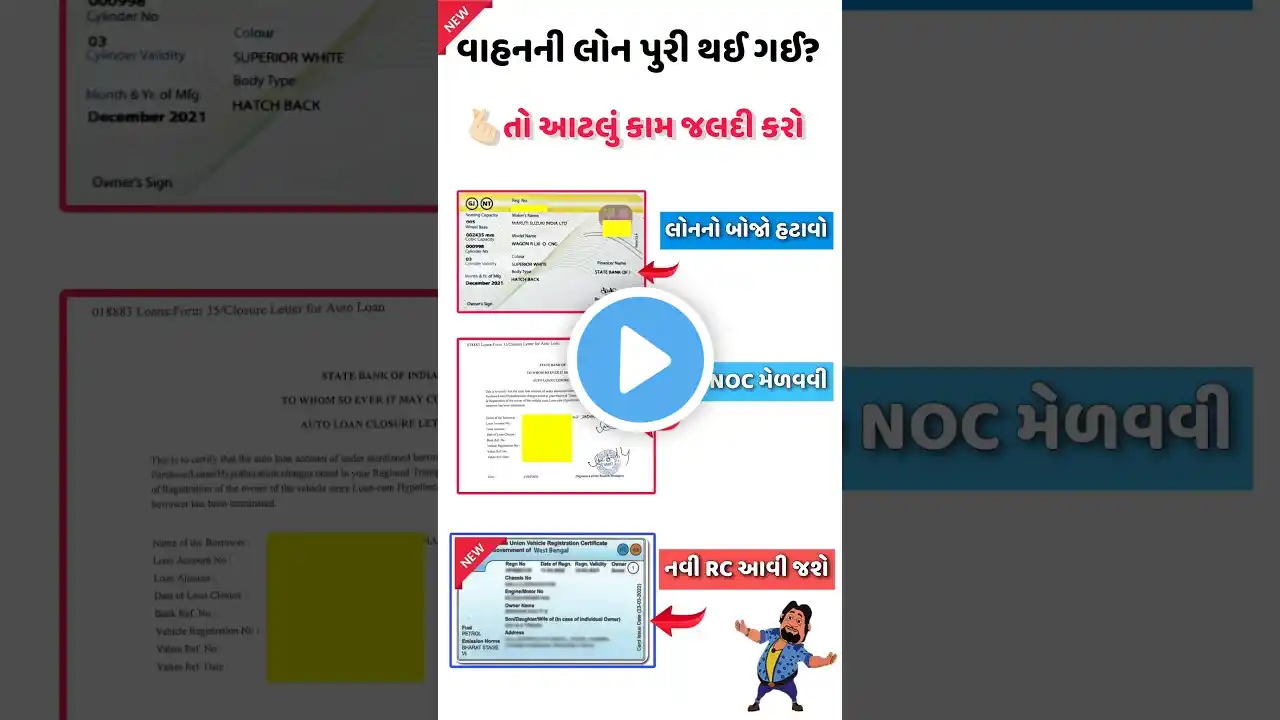

વાહન લોન પુરી થઈ જાય પછી શું? | Remove Vehicle Loan form RC | Remove Hypothecation from RC online

📃વાહન લોન પુરી થઈ જાય પછી શું? 👉 • વાહન લોન પુરી થઈ જાય પછી શું? | Remove Veh... To remove a vehicle loan hypothecation from your Registration Certificate (RC), you need to obtain a No Objection Certificate (NOC) from your lender, along with Form 35, and then submit these documents, along with other required documents, to the Regional Transport Office (RTO). Here's a more detailed breakdown of the process: 1. Obtain Necessary Documents: No Objection Certificate (NOC): After paying off your vehicle loan, request a NOC from your bank or financial institution. This confirms that they have no further claim on the vehicle. Form 35: Along with the NOC, the bank will also provide Form 35, which is required for hypothecation removal. Other Required Documents: Original Registration Certificate (RC). Insurance policy of the car. Copy of the loan closure statement. Address proof. Identity proof. PUC (Pollution Under Control) certificate. Copy of the loan agreement. PARIVAHAN WEBSITE: https://parivahan.gov.in/parivahan/ How do I remove my loan details from RC? How can I remove my car loan? How do you remove hypothecation from RC? Is it mandatory to remove financer name from RC? RTO hypothecation removal process online Hypothecation removal from RC fees RTO hypothecation removal process online Gujarat Parivahan hypothecation removal Remove hypothecation from RC RTO hypothecation removal process online Maharashtra How to check hypothecation on RC RTO Form 35 pdf download #RemoveLoanInRC #RemoveVahanLoanfromRC #RemoveBankloanFromRC #helloeducation #vikramdadukiya