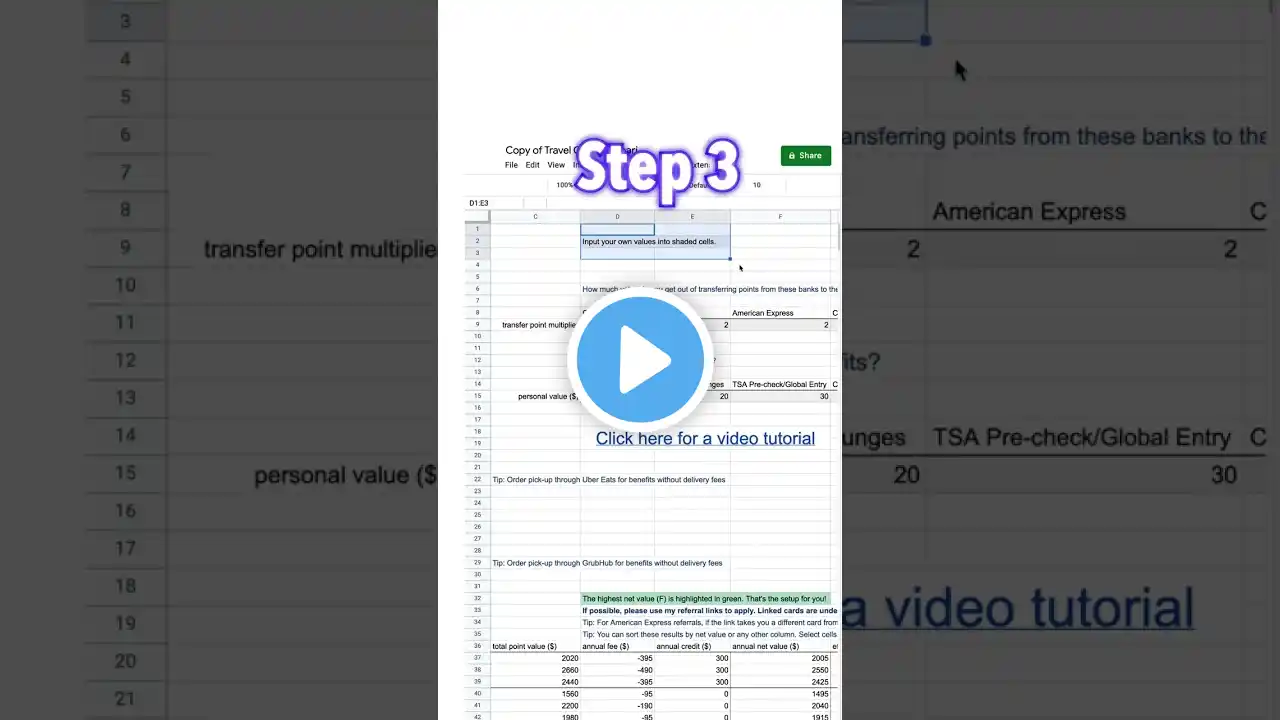

Find the BEST Travel Credit Cards for You in 3 Steps! #creditcard #travel #finance #shorts

Travel credit cards can be incredibly rewarding, but how do you know which ones will give you the most value? I created a spreadsheet that will calculate and compare the expected rewards (points/miles, net dollar amount, and effective cash back rate) you will earn each year for a number of different travel card setups, based on your spending habits. 📊 You can access the spreadsheet here: https://docs.google.com/spreadsheets/... If you choose to apply for one of these cards, please use my referral links. 💳 American Express (any card): https://americanexpress.com/en-us/ref... 💳 Capital One Venture X: https://capital.one/3V8z3cZ 💳 Capital One VentureOne: https://capital.one/3FZLPXw 💳 Capital One Quicksilver: https://capital.one/3Xc971F 💳 Chase Sapphire line: https://www.referyourchasecard.com/6j... 💳 Chase Freedom line: https://www.referyourchasecard.com/18... Otherwise, if you'd like to support this work directly, you can leave me a tip through Cash App or Venmo. Cash App: $travelcards Venmo: @travelcards Thank you for your support! List of primary travel credit cards included in the spreadsheet: Capital One Venture X Capital One Venture Capital One VentureOne Chase Sapphire Reserve Chase Sapphire Preferred American Express Platinum American Express Gold American Express Green American Express Everyday Preferred American Express Everyday American Express Blue Business Plus Citi Premier List of secondary credit cards used to supplement the above included in the spreadsheet: Capital One Savor Capital One SavorOne Capital One Quicksilver Chase Freedom Unlimited Chase Freedom Flex Citi Rewards+ Citi Double Cash Citi Custom Cash If there are any other cards or card setups you think belong on this list, or any general suggestions about how to improve the spreadsheet, please let me know in the comments.