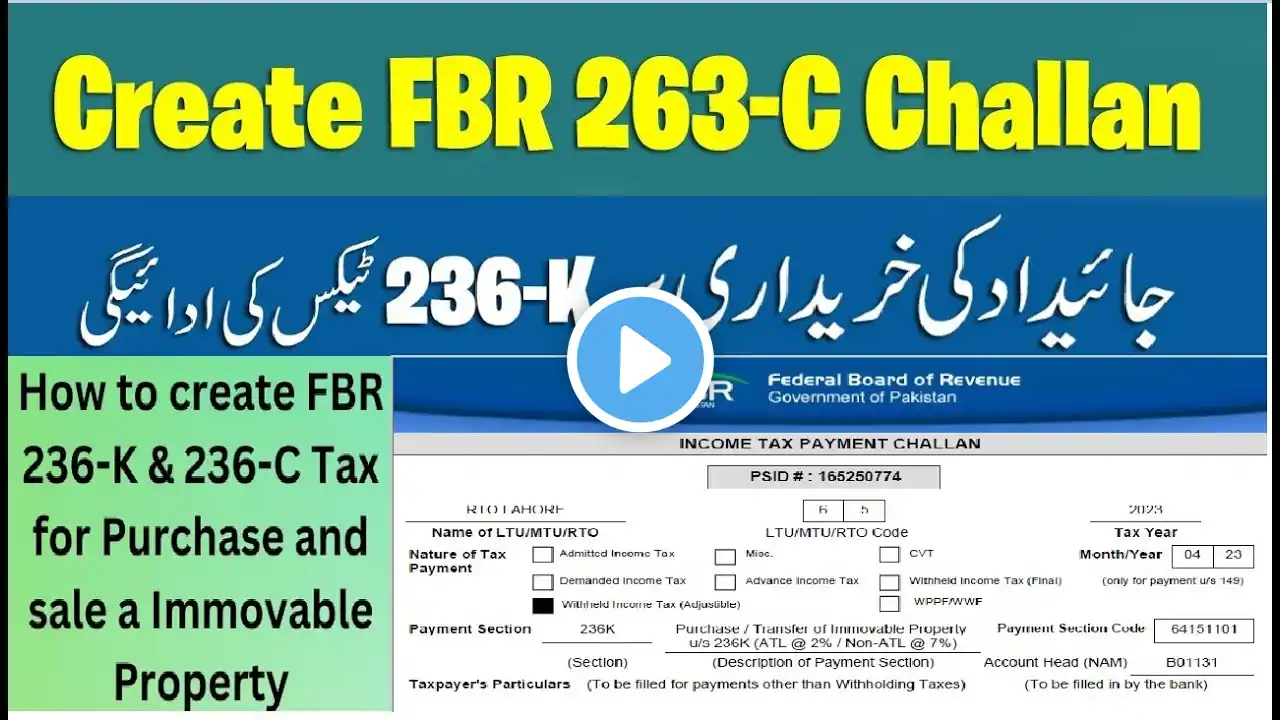

How to create 236c and 236k FBR challan in 2023 | Tax on Purchase on Property & Sale of Property

#How to create 236C #236C #263k #FBR In this video you'll learn how to Create 236C Tax Challan and 236 K Tax Challan. 236K Tax on purchase of property and 236c tax on sale of property. Tax on immovable property is being deducted by the Sub-Registrars and Housing Societies. In the e-Payments tab, the person will access Create Payment and then select Income Tax Annual Return option. The resulting selection will lead you to Income Tax e-Payment page. On this page a payment slip (PSID) will be created by: Selecting the relevant Tax Year Select NTN # for 236C Chalan Typing the Tax amount due Selecting the mode of payment Clicking the create button on the bottom of the page Confirm the e-Payment created. This will successfully create your e-Payment slip. The e-Payment slip can be deposited in any National Bank (NBP)/State Bank (SBP) branch. Select the nearest city where you want to deposit the payment slip from the drop down list. Click the print button to download the PSID on your computer. Deposit the PSID in any of the available branches of the city of your choice. For directions on how to make e-payments kindly view the manuals for e-payment. 236c 236k FBR Property Tax Filer Non-Filer Chalan Challan Online CPR PSID NTN Land Record