5 Critical Money Mistakes Keeping you poor

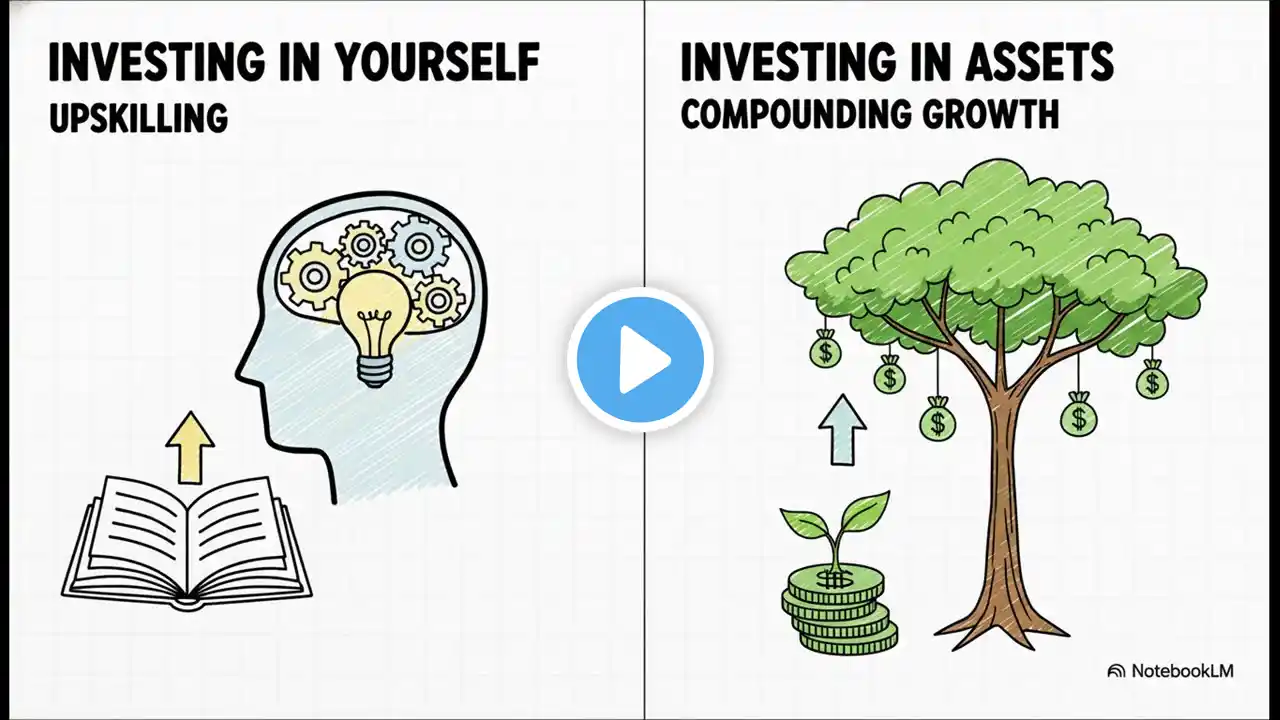

5 Critical Money Mistakes Keeping you poor #5criticalmoneymistak #moneymistak This mistake happens when you consistently spend more money than you earn. Many people fall into the trap of buying things they can’t afford, often using credit cards, loans, or other forms of debt to fund their lifestyle. Over time, this leads to mounting debt, high interest payments, and financial stress. Without a clear budget or understanding of your financial limits, this behavior becomes a cycle that’s hard to break. Why it's harmful: The more you spend beyond your income, the harder it becomes to save or invest. Over time, you may find yourself trapped in debt, with little room to grow your wealth. Solution: Track your expenses and create a realistic budget. Cut back on non-essential spending and prioritize savings. Try to live within or below your means to avoid accumulating debt. 5 Critical Money Mistakes Keeping you poor money mistake money mistake solve money mistakes money mistakes to avoid mistakes that keep you poor money mistakes that keep you poor money mistakes to avoid in your 30s money mistakes in your 20s financial mistakes biggest money mistakes 5 money mistakes to avoid money tips 3 money mistakes keeping you poor Financial Mistakes Critical Money Mistakes 5 Critical Money Mistakes Keeping you poor investment formula