Difference between Islamic Banking and Conventional Banking - Islamic VS Contional Banking

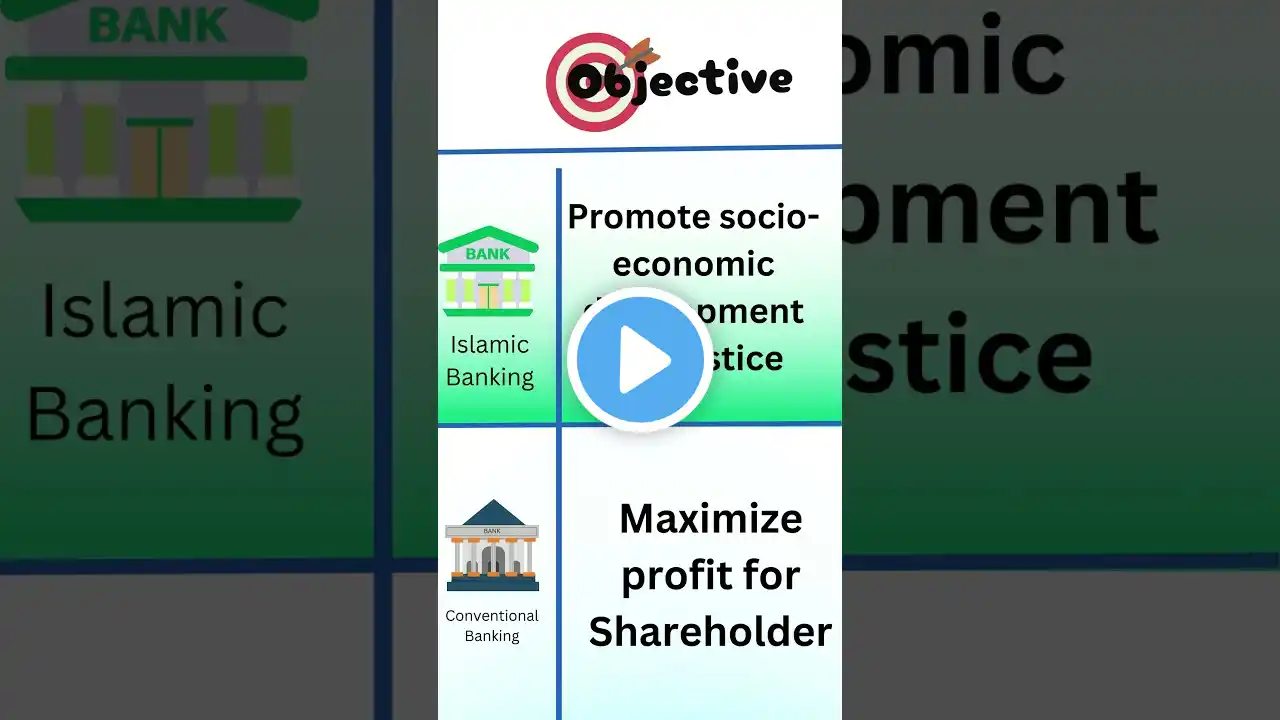

Islamic banking is a banking system that is based on the principles of Islamic law (Sharia). It is a rapidly growing industry in many Muslim-majority countries, as well as in Western countries with large Muslim populations. In contrast to conventional banking, Islamic banking is characterized by a prohibition on the charging of interest (riba), as well as a focus on risk-sharing rather than debt-based financing. This means that Islamic banks typically offer products and services that are structured differently from those offered by conventional banks. Islamic banks promote ethical and responsible banking practices. They avoid investments in certain industries, such as alcohol or gambling, and they seek to promote social and environmental causes. Also, Islamic banks typically place a strong emphasis on community involvement and development. The major difference between Islamic banking and conventional are explained in this video. #AIMS #Education #elearning #Training #OnlineCourses #IslamicBanking #IslamicFinance #Banking #Finance