IAS 12 - Deferred Tax

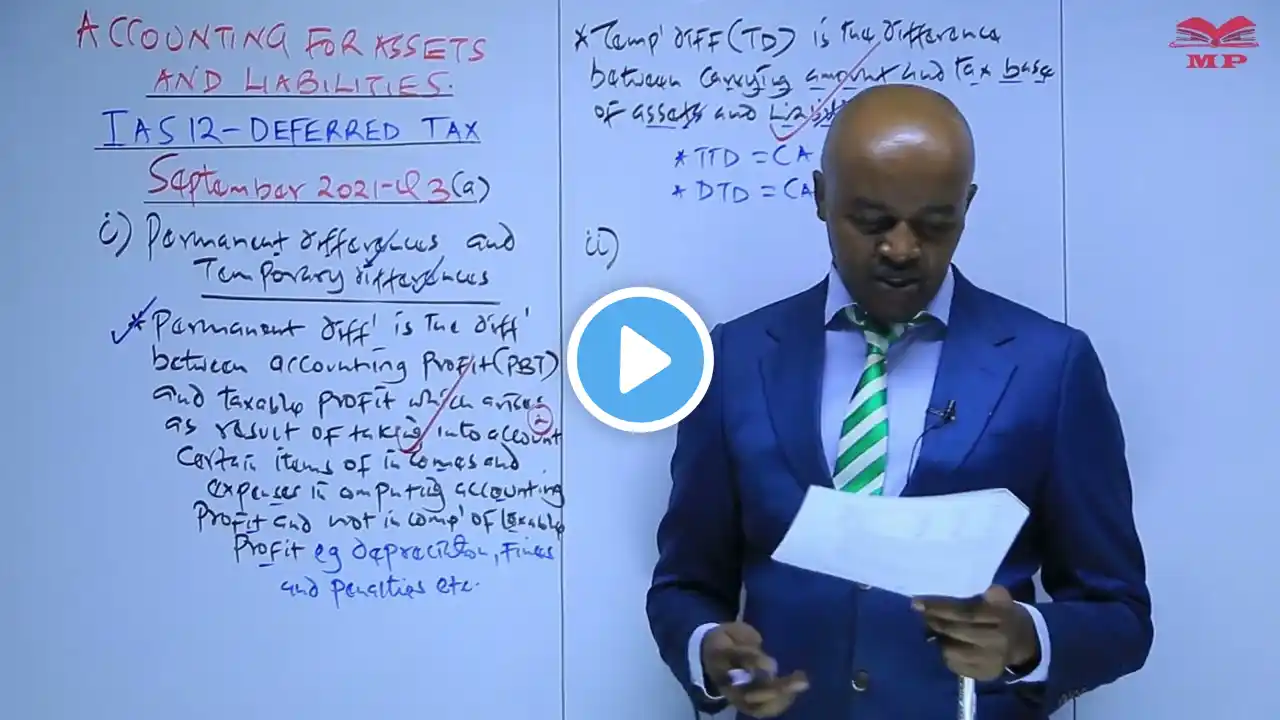

📊 IAS 12 – Deferred Tax – Accounting & Finance Lesson 💼 Learn the principles of deferred tax under IAS 12 in this detailed accounting and finance lesson. Understand how deferred tax arises, how to account for it, and its impact on financial statements. 💡 Key Topics Covered: Overview of IAS 12 and its objectives Definition and types of deferred tax: deferred tax assets and liabilities Recognition and measurement of deferred tax Temporary differences and their accounting treatment Practical examples and tips for exam preparation 🎯 Who Should Watch: Accounting and finance students studying IFRS and taxation Professionals preparing financial statements under IFRS Learners preparing for exams in accounting, finance, or corporate taxation 📘 Learn With Manifested Publishers: Structured lessons, examples, and exercises designed to help learners master IAS 12 and deferred tax accounting principles. 💻 Visit: www.manifestedpublishers.com 📞 Call/WhatsApp: +254 724 173 845 #IAS12 #DeferredTax #AccountingStandards #FinanceEducation #IFRS #ManifestedPublishers #ExamPrep #CorporateAccounting