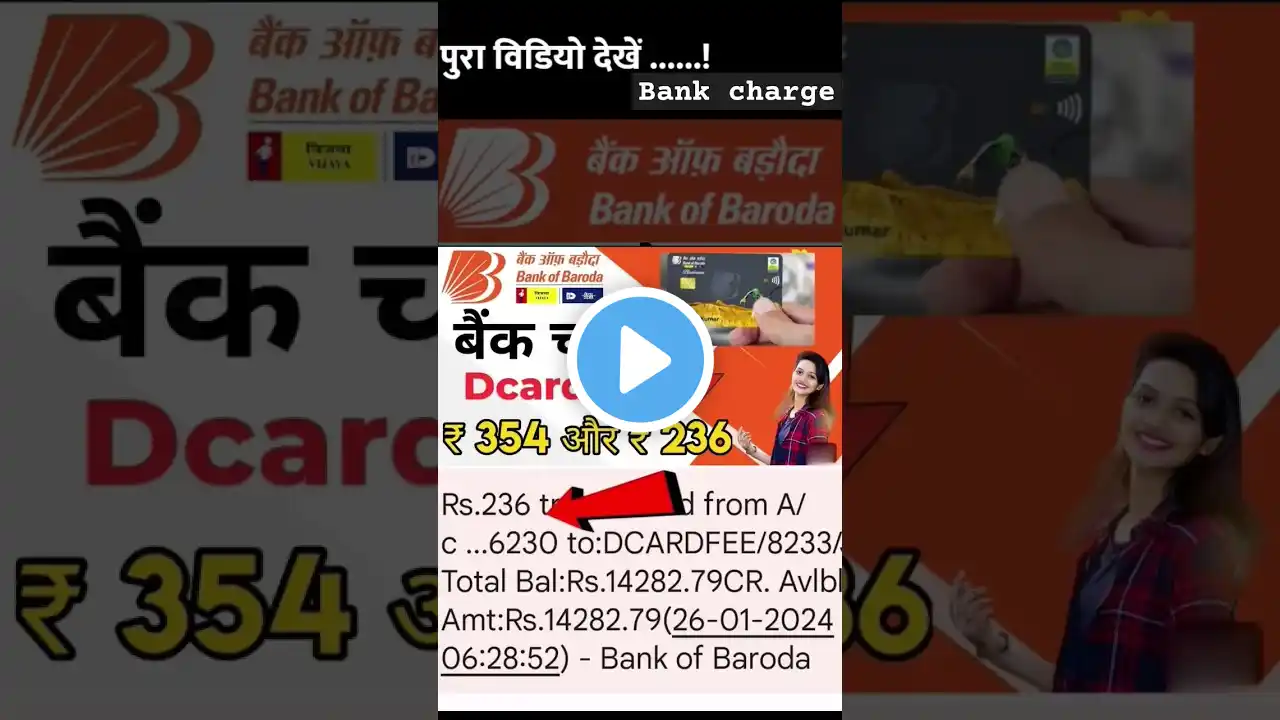

dcardfee 354 bank of baroda | 354 rupees charge in bob bank

Bank of baroda dcardfee charge sms rs 354 or rs 236 charge in bob. dcardfee 354 bank of baroda, dcardfee 295 bank of baroda, bank of baroda dcardfee means, dcardfee bank of baroda in hindi, d card fee bank of baroda, what is dcardfee in bank of baroda, bank of baroda dcardfee, dcardfee bank of baroda, dcardfee charges bank of baroda meaning "In this video, we will discuss the fees associated with using a Bank of Baroda D-card. A D-card is a debit card issued by Bank of Baroda that allows you to access your bank account and withdraw money from ATMs. However, there are fees associated with using this card, such as transaction fees, annual fees, and more. We will explain these fees and why they are charged, so that you can make informed decisions when using your Bank of Baroda D-card. Watch this video to learn more about the fee structure for Bank of Baroda D-cards." Bob dcardfee Bank of Baroda atm charge Bank of Baroda, like most banks, charges fees for various services related to ATM usage. These fees can include: ATM withdrawal fees: Fees for withdrawing cash from an ATM that is not part of the Bank of Baroda network. Balance inquiry fees: Fees for checking your account balance at an ATM that is not part of the Bank of Baroda network. Transaction decline fees: Fees for transactions that are declined due to insufficient funds or other reasons. International transaction fees: Fees for using your debit card at an ATM or point-of-sale terminal outside of India. It's important to note that the fees for ATM usage can vary depending on your account type, the type of transaction you are performing, and the location of the ATM. I would recommend checking with Bank of Baroda directly or reviewing the fee schedule on their website for the most up-to-date and accurate information.