Should You Stop Mutual Fund SIPs in a Market Crash?

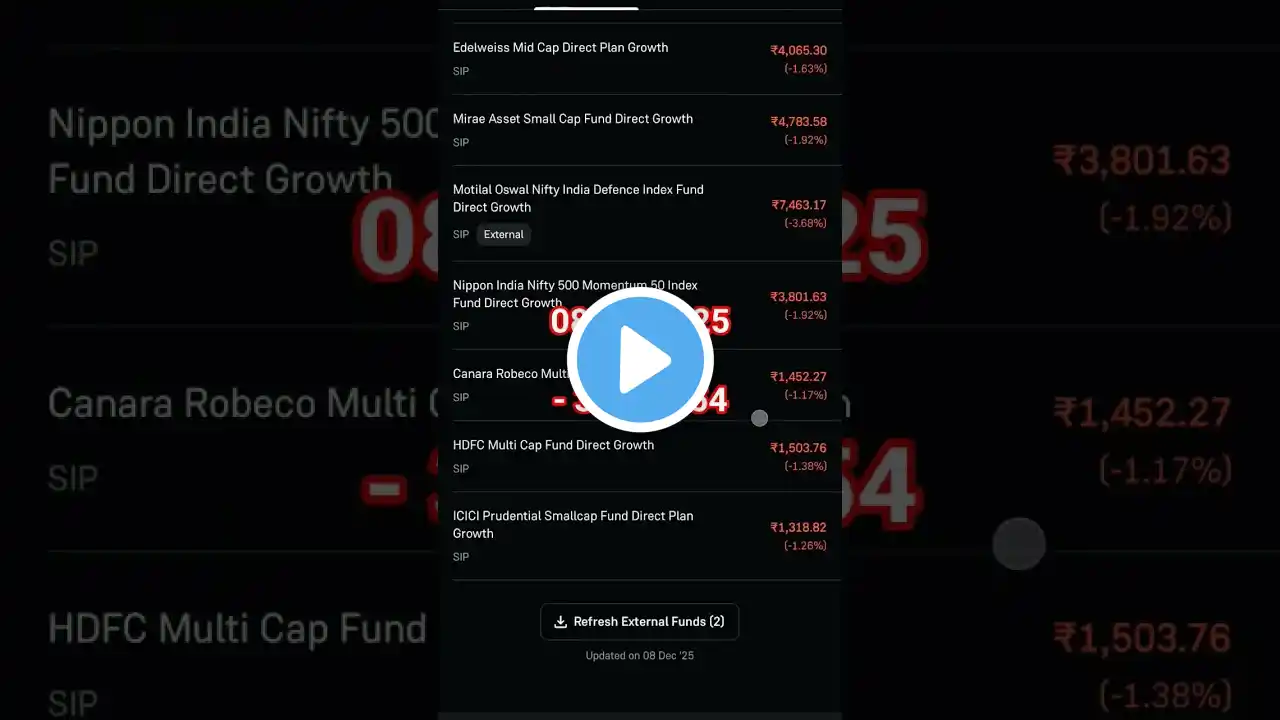

Should You STOP mutual fund SIP in a Falling Market? (Don’t Make This Mistake!) | Part 1 of 5 Have you ever felt that nagging fear when the stock market starts falling and your SIPs are still being deducted every month? Do you wonder:👉 “Should I pause my mutual fund SIP now?”👉 “What if the market keeps crashing?”👉 “Am I throwing good money after bad?” You're not alone — thousands of investors face this emotional dilemma during market downturns.Welcome to Part 1 of our 5-part series that helps you answer one of the most important investing questions of all time: "Should you continue your mutual fund SIP in a falling market?" 🎯 What This Video Covers (Part 1): In this first episode, we focus on the emotional side of investing — because behavior plays a BIGGER role than knowledge when it comes to wealth creation. ✔️ Why most investors stop SIPs when the market is down✔️ What history teaches us about this common mistake✔️ Real-world examples of investors who stopped SIPs during crashes✔️ How your long-term compounding gets affected if you stop now✔️ 📊 Here’s Why This Video Is a Must-Watch: Even the smartest investors get nervous when markets fall.But the real question is not “How do I avoid loss?” — it’s “How do I build wealth despite volatility?” If you've ever paused your SIP… or thought about it…This video gives you the clarity, confidence, and conviction to make the right decision — not just emotionally, but with logic and long-term thinking. 💡 Key Takeaways: 1. SIPs Work Best in Down MarketsSIPs are designed for volatility. When markets fall, you get more units for the same amount — it's like buying things on sale. Don’t miss this opportunity. 2. Stopping SIPs Breaks the Compounding ChainPausing an SIP for 6–12 months may feel like a safe move — but it can hurt your end corpus by lakhs or even crores in the long run. 3. Your Mind Plays Tricks in Bear MarketsWe’re hardwired to feel pain 2x more than gain. In this video, we break down the behavioral bias that makes investors exit at the worst possible time. 4. Real Stories of SIP MistakesHear how some investors paused during COVID, only to miss out on the sharp recovery. 📅 What’s Coming: 👉 Part 2: Real SIP Return Data During Crashes & Recoveries👉 Part 3: When Should You Actually Pause Your SIP? (If At All)👉 Part 4: Better Alternatives to SIP in a Volatile Market👉 Part 5: Final Summary & SIP Strategy for Next 10 Years 📚 Real Examples & Research-Backed Insights In this series, we go beyond theory. We show you actual data from:✔️ Nifty 50 SIP returns across 2008, 2011, 2020 crashes✔️ Sectoral SIPs and their performance post crash✔️ What happened to investors who continued vs. those who paused✔️ How a ₹10,000 SIP paused during a crash leads to huge loss in corpus over 20 years The numbers speak louder than fear. 📌 Quick Questions Answered in This Video: What happens if I stop my SIP when the market crashes? Is it better to invest lump sum during a crash instead of SIP? Should I switch to liquid or debt funds when the market is down? How do I stay emotionally stable when I see negative returns? 🧮 The Long-Term Impact of Missing SIPs: Even skipping just 6–12 months of SIP during a bear market may: ❌ Delay your wealth goals❌ Lower your final corpus significantly❌ Cause you to miss market rebounds that come without warning Remember: the biggest rallies often come right after the deepest falls. If you’re not in the market, you miss them. 🎥 Why This Series is Different: Most videos on SIPs give generic advice like “stay invested.”But in this series, we give you: Real data Behavioral insights Actionable strategies Clarity on when not to follow SIPs blindly A balanced view (not just optimism or fear) We simplify investing without dumbing it down. No jargon, no fluff — just what you need to know to protect and grow your money. 💬 Drop a Comment: What’s your SIP experience been like?Have you ever paused your SIP? Did you regret it?Tell us your thoughts — your story might help someone else make a better decision. 📢 Share This Video With: 📩 Friends and family who invest regularly📲 WhatsApp groups focused on finance💼 Your office colleagues doing SIPs👪 Young earners starting their investing journey 🙏 Support the Channel: If you found value in this video, here’s how you can help us grow: 👍 Like the video📝 Leave a comment — even a short one helps🔁 Share this with 2-3 people you care about📌 Subscribe for more high-quality investing contentYour support means the world to us as we build this education-focused channel together. Thanks for watching!Remember — markets fall, emotions rise — but wealth is built by staying calm and consistent.Stay invested. Stay informed. Stay disciplined.See you in Part 2! #SIP #MutualFundsIndia #InvestingForBeginners #MarketCrash #SystematicInvestmentPlan #IndianStockMarket #FinancialFreedomIndia #BehavioralFinance #PersonalFinanceIndia #FallingMarketSIP #ShouldIStopSIP