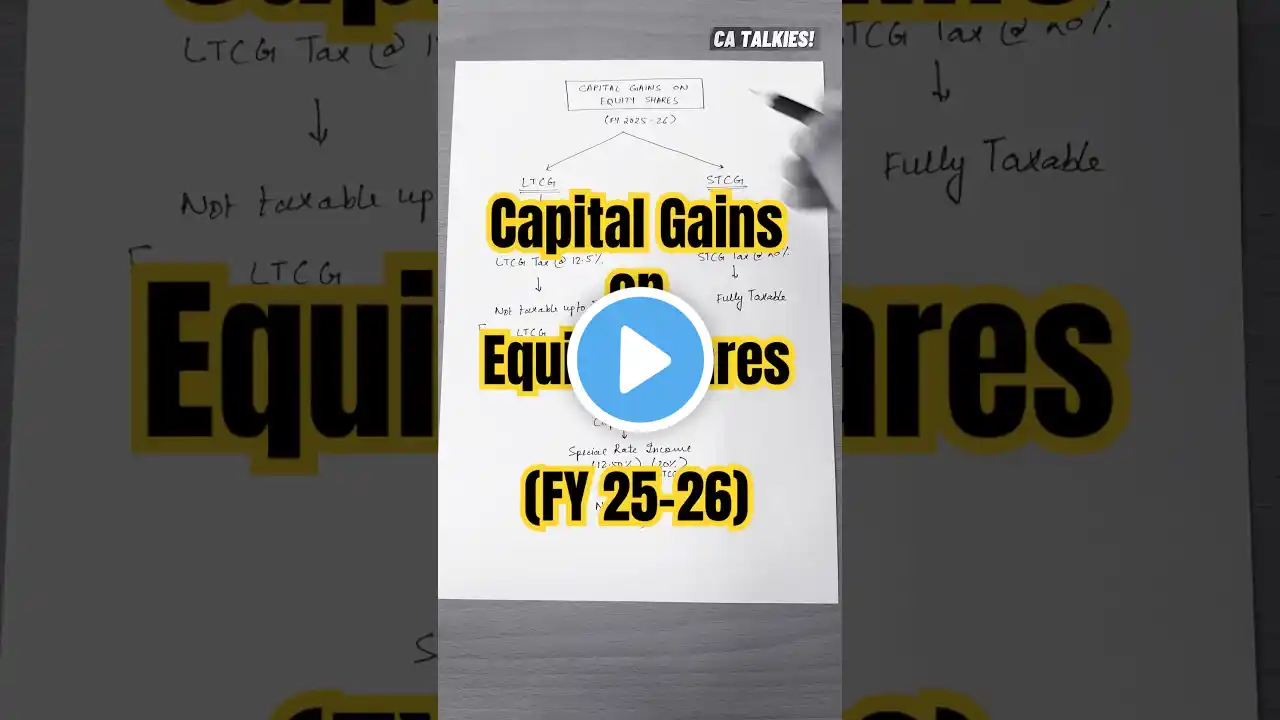

Capital Gains on Equity Shares | FY 2025-26 | Explained

📢 LTCG vs. STCG on Equity Shares (FY 2025-26) Explained! 📢 💡 Confused about how capital gains on stock market investments are taxed? Let’s break it down in a simple way! 🔹 Short-Term Capital Gains on Equity Shares If you sell listed equity shares within 12 months of purchase, the profit is classified as STCG and is taxed at a flat 20% irrespective of your income tax slab. 🔹 Long-Term Capital Gains on Equity Shares If you hold listed equity shares for 12 months or more before selling, the profit falls under LTCG. LTCG up to ₹1.25 lakh per year is tax-free. Gains above ₹1.25 lakh are taxed at a flat 12.50% without indexation. 📢 Narrated by: CA. Vidur Krishna Bindal, FCA For Feedback: Email: [email protected] 💬 Drop your questions in the comments & don’t forget to 👉 LIKE, SHARE & SUBSCRIBE for more finance tips! #LTCG #STCG #CapitalGainsTax #StockMarket #TaxPlanning #EquityInvesting #Finance #investing #wealth #stockmarket #stocks #sharemarket #capitalgains