Who Should File ITR 2? | ITR 2 Form Explained | Income Tax Return Filing for FY 2024-25 #itr

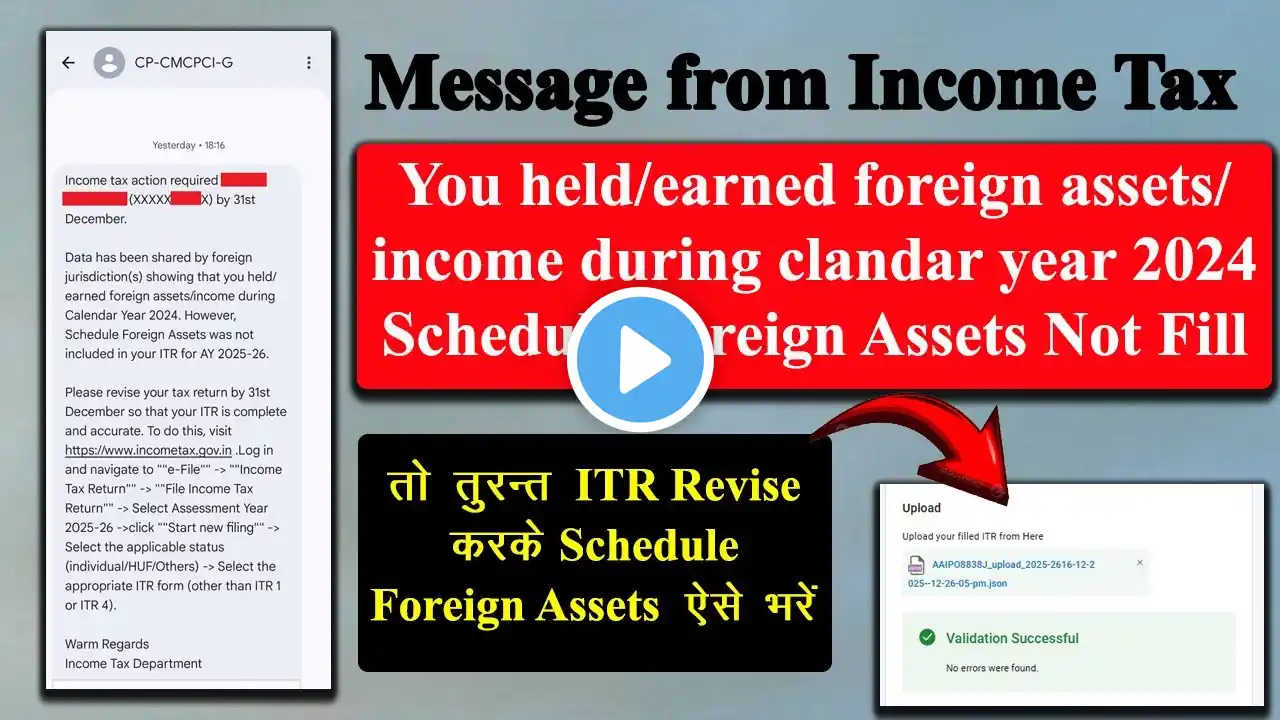

Confused about whether you need to file ITR 2 this year? 🤔 In this video, we clearly explain who should file ITR 2 for FY 2024-25 (AY 2025-26) — with simple examples to help you identify the right ITR form for your income type. ✅ Topics Covered: What is ITR 2? Who should file ITR 2 in India? Difference between ITR 1 and ITR 2 ITR 2 for salaried individuals, capital gains, and multiple house properties Step-by-step filing guidance for ITR 2 online 💡 Who Should Watch: Salaried individuals with capital gains (shares, mutual funds, property) People with more than one house property Individuals earning income from foreign assets or investments Anyone confused between ITR 1 and ITR 2 📢 Stay tuned till the end for expert tips to avoid common ITR filing mistakes! 📌 Tags: ITR 2 filing, Who should file ITR 2, ITR forms India, ITR 2 for salaried person, Income Tax Return 2025, ITR filing online, ITR 1 vs ITR 2, ITR 2 capital gains 💼 About Us: We help individuals and businesses across India with hassle-free ITR, GST & TDS filing. Visit our website or contact us for professional tax filing assistance. #ITR2 #IncomeTaxReturn #ITRfiling #ITR2Form #TaxFilingIndia #IncomeTaxIndia #CapitalGains #viral #trending #reelinstagram #reelsindia #youtubeshorts #tax #taxes #incometax #gst #finance #accounting #taxseason #smallbusiness #entrepreneur #business #taxconsultant #taxplanning #taxtips #india #gstindia #incometaxindia #taxreturn #compliance #accountant #incometaxreturn #gstreturns #gstfiling #tds #tcs #itrfiling #gstupdates #gstregistration #taxation #taxservices #taxreturns #gstcompliance #tdsfiling #tcsfiling #accountingservices #ca #charteredaccountant